The “perfect storm” can cause chaos for ships on the high seas…

And it could do the same thing for millions of Americans in the months ahead.

More specifically, in this case, I’m referring to the perfect storm of energy shortages…

The energy market is facing the same supply-chain issues as most industries today. That includes low levels of raw materials and low capacity due to the labor shortage.

These issues have created delays in expanding the capacity of our energy-production facilities.

It gets worse for U.S. consumers like you and me, too. As the costs increase at these facilities, they get passed on to us.

As you know, Russia’s war in Ukraine put the U.S. energy industry under the gun.

The European Union agreed to ban the majority of Russian energy imports earlier this year. But all the people living in those countries still need to heat and power their homes.

So instead, they’ll turn elsewhere to meet their needs – like American natural gas. That’s great for U.S. companies in the space. But reduced supply isn’t good for U.S. consumers.

The social stigma against “fossil fuels” like oil and natural gas isn’t helping, either. That movement led to a lack of financing in the sector for building out production in recent years.

When you put everything together, it’s a classic setup for the perfect storm. And if you think it’s bad now, just wait…

Barring a dramatic change, this perfect storm will start to overwhelm us in four months.

Let me explain…

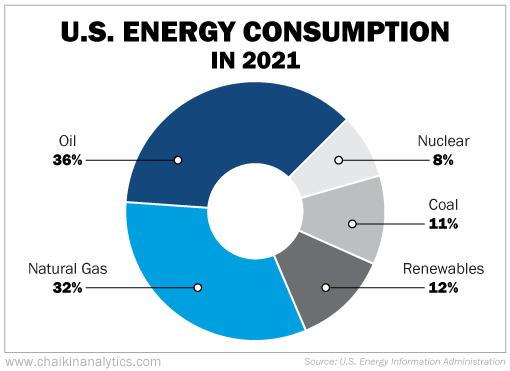

Natural gas and oil account for roughly 70% of all energy consumed in the U.S., according to the Energy Information Administration (“EIA”). Take a look…

Now, we’re currently at the end of June. You might have your sights set on summer fun.

But winter is just a few short months away. And that’s when energy demand really gets going – especially for natural gas…

Winter consumption is usually higher than consumption during the summer. The reason is simple…

We’re typically inside more due to the colder temperatures. And the days are shorter, which requires more indoor light.

Plus, natural gas prices are already soaring…

According to the EIA, natural gas prices averaged $8.14 per million British thermal units (“MMBtu”) in May. That’s 180% higher than the same period in 2021.

And the EIA expects the price of natural gas delivered to electric generators to average $8.81 per MMBtu this summer. That would be a 124% jump over last summer.

In years with normal winter temperatures, the supply sometimes isn’t enough to meet demand. And even worse, this coming winter is shaping up to be especially tight…

You see, a couple of weeks ago, an explosion occurred at a liquefied natural gas (“LNG”) facility in Texas. That LNG plant’s supply was earmarked for exports to Europe.

With fears about reduced future supplies, natural gas prices rose 12% higher across Europe after the explosion. And in the United Kingdom, they soared 33%.

Plus, even before the explosion, Bank of America warned in a research report that the export goals between the U.S. and Europe were “challenged.” The financial institution’s researchers cited low capacity to deliver, along with the massive supplies needed.

Folks, most investors don’t know it yet… But the perfect winter storm is already raging.

Now, you shouldn’t race to buy just any energy stock right now…

The sector has come under severe pressure along with the rest of the market in recent days. Energy stocks and exchange-traded funds are down 20% or more from their highs.

Fortunately for investors, this pullback is likely temporary. A perfect storm is brewing after all…

When winter comes in a matter of months, energy consumption will once again surge over summer consumption. Your electric and gas bills will likely hit their highest level in decades.

So for now, keep an eye on the energy sector. And start saving every penny you can.

Good investing,

Pete Carmasino