Regular readers know I love technical analysis…

For one thing, it forces folks like us to look outside ourselves and avoid getting emotional.

It’s easy to get “stuck” as an investor…

The same ideas crop up again and again. So we’re often blinded to novelty.

Now, I’m not against doing what works. But sometimes, “what works” is something you would never consider on your own.

That was the case when I first wrote about the opportunity in Turkey last September…

I’m sure some of you who read my original piece thought it was a stretch. After all, foreign markets were in turmoil. And Turkish stocks weren’t on most investors’ minds.

Despite that… the Power Gauge noticed the opportunity.

And I couldn’t help but share its unusual findings with you.

Then, in early November, I followed up with an exciting update. The iShares MSCI Turkey Fund (TUR) had soared roughly 35% in about five weeks.

At the time, I told readers that technical analysis and the Power Gauge “still feels like magic to me.” Although I know all the formulas behind the system, its results can still surprise me.

Well, folks… the Turkey surge is coming to an end.

Today, we’ll take a quick look at how this opportunity has played out since November. And we’ll cover why I’m confident that it’s now time to look elsewhere in the markets…

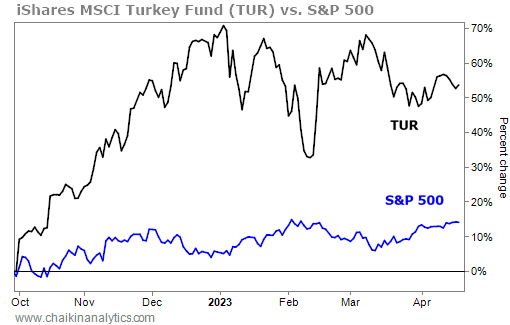

In short, the iShares MSCI Turkey Fund smashed the benchmark S&P 500 Index since our first essay last September. Take a look…

TUR soared more than 50% over that span. Meanwhile, the S&P 500 returned about 14%.

That’s absolutely massive outperformance.

Now, take another look at the above chart…

Notice that TUR’s performance has leveled off in 2023. The exchange-traded fund (“ETF”) is actually down about 8% so far this year. And the Power Gauge recognizes what this recent reversal means…

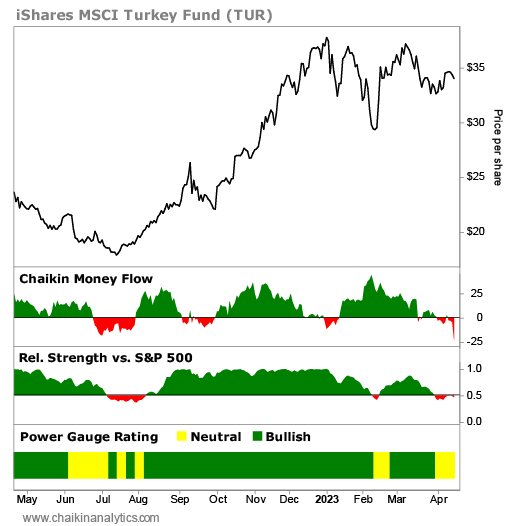

Our system moved from “bullish” to “neutral” on TUR in late March.

Even worse, the so-called “smart money” is exiting the trade (which we can see using the Chaikin Money Flow indicator). And the ETF is now underperforming the S&P 500…

Folks, this is about as clear of a signal as we could hope for…

A little bit of technical analysis helps us see that it’s time to move on from Turkey. The Chaikin Money Flow indicator, relative strength, and the Power Gauge rating are all going the wrong way.

Could Turkish stocks turn it around?

Sure.

But I’ll be the first to admit that I’m not an expert on these stocks…

The power of technical analysis – and the Power Gauge itself – helped us uncover this opportunity last September.

So I’m more than happy to use technical analysis today to define the end of this surge, too.

Good investing,

Marc Chaikin