At this point, we all know that U.S. stocks are suffering…

The broad market S&P 500 Index is down roughly 24% so far this year. And the tech-heavy Nasdaq Composite Index is down around 31% in the same span.

Those declines are staggering. But notably, they’re U.S.-focused.

Of course, as investors, it’s critical to look beyond our home country to get the full picture. And frankly, it’s even worse almost everywhere else today…

For example, the British pound recently hit a record low against the U.S. dollar. It briefly traded for as low as roughly $1.03. And today, it’s at about $1.10.

That’s a huge move in the world of currencies…

Back in 2012, the pound traded for roughly $1.50. And before the 2008 housing bust, its value equaled more than $2.

The simple fact is… foreign markets are in turmoil as well.

We’re seeing that play out in a variety of ways. The wildly fluctuating movement of global currencies is just one example.

So today, let’s check the pulse of the rest of the world…

We’ll take a closer look at several foreign markets through the lens of the Power Gauge. It’s mostly a sea of red, of course. But you’ll find at least one surprising bright spot…

The global level of the downturn we’re facing is unescapable. And we can see that most clearly by looking at worldwide stock funds that intentionally exclude the U.S. market…

The iShares MSCI ACWI ex U.S. Fund (ACWX) does exactly that. It holds stocks and currencies outside the U.S. Its biggest positions include Taiwan Semiconductor Manufacturing, Swiss companies Nestlé and Roche, and Chinese holding company Tencent.

At any given time, it’s an easy way to answer the question… is the problem we’re facing global or only happening in the U.S.?

Today, the answer is as clear as it gets…

ACWX is down about 28% so far this year. That’s worse than the S&P 500 and only slightly better than the Nasdaq’s performance.

The Power Gauge also paints a dismal picture for foreign stocks in general…

Right now, 35 of ACWX’s rated holdings earn a “bearish” or worse grade. Meanwhile, 73 are stuck in “neutral” territory. And just eight stocks are rated as “bullish” or better.

So we have a simple answer… International stocks are clearly struggling today.

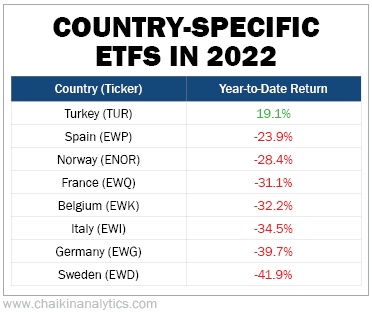

Now, let’s go on a world tour. That will give us an even clearer picture. The following table shows the year-to-date returns for eight popular country-specific exchange-traded funds (“ETFs”)…

If you generally ignore foreign stocks, you might find a couple of surprises here…

First, you’ll find that foreign stocks aren’t a monolith. Each country has its own stock market. And these markets all move up and down at different wavelengths…

For example, most of the ETFs are down in 2022 – many even worse than the U.S. But Spain’s losses aren’t quite as bad as the other European countries on this list.

You’ll also notice that I’ve included an unusual bright spot…

The iShares MSCI Turkey Fund (TUR) is significantly outperforming. It’s up around 19% in 2022. That’s incredible considering that most global stocks are getting crushed this year.

Even better, it earns a “very bullish” rating from the Power Gauge. And it has maintained that top-notch rating almost consistently since mid-March.

Now, I’m guessing that you haven’t thought much about Turkish stocks before. And truthfully, I haven’t either.

But that’s part of why the Power Gauge is such a powerful tool…

Its simple rating system forces us to examine areas we would normally ignore. And importantly, it reminds us that opportunities do exist – even in today’s tough market.

Above all else, remember to keep hunting for opportunities. Don’t get tunnel vision with U.S. stocks. And don’t get discouraged even if most of the world’s stocks are down.

If you’re interested in a global bright spot, consider Turkish stocks today.

Good investing,

Marc Chaikin