Everyone always wants to cut out the middleman…

Going straight to the source seems much faster. After all, it involves fewer people.

But when it comes to the global economy… middlemen are critical.

The economy involves too many moving parts. It’s too complex to go straight to the source.

Think back to the COVID-19 pandemic…

The supply-chain crisis showed us how messy things can get when everything breaks down.

For example, due to issues with the supply chain, many carmakers couldn’t get a lot of needed parts – like microchips. So in turn, a lot of Americans couldn’t get new cars.

Heck, some builders couldn’t even get enough windows to finish new homes.

It’s not just about product availability, either. It’s also about costs and timing…

No matter the item, manufacturers make tough cost-related choices every day. They balance overspending on inventory and having what they need, when they need it.

Coordinating the best delivery time is important as well. Nobody wants Component A to arrive a month before Component B if they’re both needed at the same time.

It might surprise you, but the Power Gauge sees why middlemen are so important. And right now, our system is “bullish” on this critical group of companies…

It’s hard to make everything go right, of course. The supply chain involves millions of little items from many thousands of manufacturers all moving across the world at the same time.

Put simply, logistics isn’t a glitzy business. And doing it poorly causes chaos.

We’re now three years past the earliest days of the COVID-19 pandemic. The supply chain still hasn’t fully recovered. But it’s getting better. And the Power Gauge helps us see that…

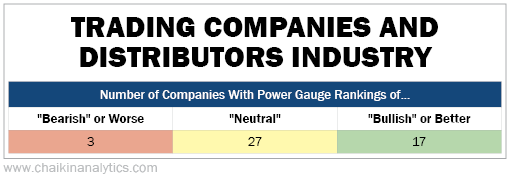

Specifically, the Power Bar ratio shows us that the trading companies and distributors industry has many more “bullish” opportunities than “bearish” ones today. Take a look…

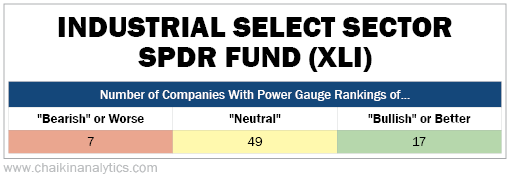

In addition to that industry, the industrial sector is more “bullish” than “bearish” right now. Here’s the Power Bar ratio for the Industrial Select Sector SPDR Fund (XLI)…

In short, the Power Gauge isn’t screaming that this corner of the market is the “best of the best.” As you can see, both tables are filled with a substantial number of “neutral” stocks.

But the Power Bar ratios are firmly in “bullish” territory.

Put simply, the Power Gauge sees a lot of opportunity in the economy’s middlemen today. That’s a good sign, too…

My colleague Pete Carmasino said last Friday that he’s waiting on transports and industrials to signal the next leg up for the broad market S&P 500 Index. That’s classic “Dow Theory.”

Well, the Power Gauge is signaling a “bullish” turn for industrials and related stocks today.

So I recommend paying close attention to this corner of the market in the weeks ahead.

Good investing,

Marc Chaikin