The stock market is flashing all sorts of “bullish” signs these days…

For example, in January, Chaikin Analytics founder Marc Chaikin noted that stocks had just triggered a “breadth thrust” signal. And it showed that a new bull phase could be starting.

The benchmark S&P 500 Index remains volatile today. But it’s up around 3% since then.

And on Tuesday, Marc explained how the S&P 500 just crossed a major milestone. This indicator has a 100% win rate since 1950. And it points to 19% upside over the next year.

Put simply, there’s a lot to like about stocks right now. But we’re not getting the “off to the races” type of action we expect to see in a bull market – not yet anyway.

As I’ll show you today, one indicator is getting lost in all the “bullish” talk. It has a long history of success. And it’s likely the last hurdle between us and the big bull market…

We’ll get to the specific indicator. But first, let’s get up to speed with the “Dow Theory”…

This financial theory goes all the way back to the Industrial Revolution era. Its namesake is Charles Dow, who developed the Dow Jones Industrial Average in the late 1890s.

In short, the Dow Theory has two main parts…

• Dow Jones Industrial Average

• Dow Jones Transportation Average

The Dow Jones Industrial Average tracks 30 large-cap companies in the market. Its constituents include UnitedHealth (UNH), Home Depot (HD), McDonald’s (MCD), and more.

It’s a wide-ranging gauge of the economy (and the stock market) as a whole.

On the other hand, the Dow Jones Transportation Average focuses specifically on how transportation businesses are doing. Think of railroads, airlines, and trucking companies.

Here’s where the Dow Theory comes into play…

When both of these indexes are going up at the same time, it means the economy is strong. And if they’re both going down at the same time, it means the economy is weak.

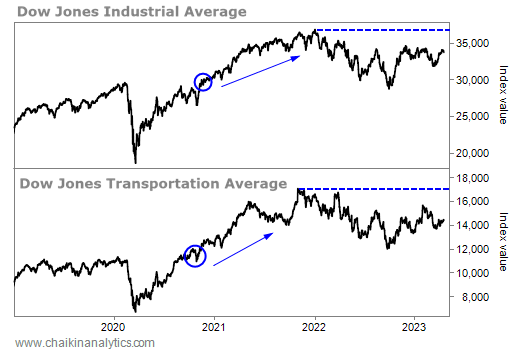

Fortunately, as investors, we can see the Dow Theory in action using price charts. And as you can see below, the chart shows that this indicator hasn’t triggered yet. Take a look…

This indicator triggers when both indexes pass their previous highs.

That last happened in November 2020. Now, that might seem late to you. But with the charts, we can see that it isn’t a “bottom” indicator – it’s a “continuation of trend” indicator.

The last time it triggered, both indexes went on big runs…

The Dow Jones Industrial Average climbed another 25% after hitting a new high. And the Dow Jones Transportation Average surged roughly 33% in the ensuing months.

This indicator doesn’t come with a perfect set of rules. However, using objective data, we can easily see the pattern when it triggers.

Remember, this indicator means the economy is healthy. And in turn, it’s further proof that stocks are headed higher. In other words, it would be an “all clear” indicator for us.

It might take time to play out. But it will boost our confidence in the bull market when it does.

As you can see, we’re not there yet. So for now, we’ll keep watching this indicator.

In the end, the Dow Theory is just another way to help investors like us understand the state of the economy (and in turn, the stock market). And today, its setup is still “neutral.”

But when this indicator triggers, we’ll know that the bull is really getting let loose.

Good investing,

Pete Carmasino