This winter, Americans enjoyed a reprieve at the pump…

Gasoline prices surged last summer. The national average eclipsed $5 per gallon in June.

But the average price plunged to around $3.10 per gallon by December. That’s a nearly 40% drop in about six months.

Don’t expect the relief to last, though. In fact… it’s already reversing.

You see, last year, the U.S. government dipped into its strategic oil reserves to push down gas prices. It hoped to help Americans make ends meet as inflation remained a threat.

And it worked.

But now, we’re on the verge of paying the consequences…

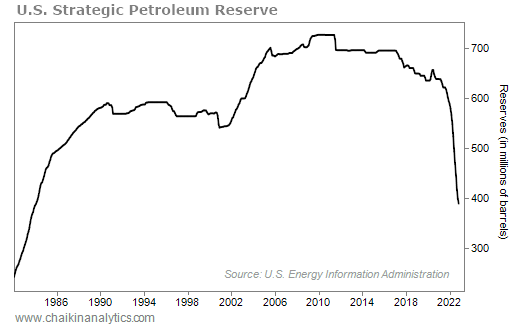

Oil reserves are now at their lowest levels in nearly 40 years. And as I’ll show you today, that’s leading to serious ramifications for Americans and the energy industry as a whole…

First, look at this chart of the U.S Strategic Petroleum Reserve…

It’s clear that the U.S. government dramatically drained our reserves to keep prices down.

Now, it has no choice but to replenish them.

The U.S. government started this process in December. And since then, gas prices are already up 10%.

As I said, the average price of regular gasoline was roughly $3.10 per gallon in mid-December. Today, the average price is around $3.40 per gallon.

This trend likely won’t change any time soon, either…

Spring is coming. Oil demand typically peaks in the summer. Peaking demand means higher prices – especially with reduced supply. And don’t forget the political instability in oil-rich countries like Russia.

To make matters worse, the U.S. won’t be able to dip into its reserves like it did last year.

So you might want to keep some extra cash as the weather gets warmer. If you’re planning to do a lot of driving this summer, it could be more expensive than you think.

But this shift will likely create a big opportunity for oil and gas companies…

So far, the folks in power in the government right now have made life difficult for domestic oil producers. But even the strictest regimes can reverse course if times get too desperate…

It happened recently when China caved to COVID-19 protesters and reopened for business. And if gas prices surge high enough this summer, the U.S. government could give in, too.

The U.S. government could provide relief for U.S. oil prices and replenish its oil reserves at the same time with one simple move. It could bring back domestic oil production.

Specifically, I’m talking about reopening closed pipelines and refineries.

Given the circumstances, this move seems inevitable. Without more domestic production, the prices at the pump will soar this summer. And the U.S. government knows it.

With that in mind, we should keep our eyes on oil and gas “picks and shovels” companies.

These companies build pipelines and supply refining equipment. And their businesses will soar if the U.S. government allows more domestic production to drive down gas prices.

Today, the Power Gauge is all over this potential opportunity…

Our system rates the SPDR S&P Oil & Gas Equipment & Services Fund (XES) as “bullish” today. Nine of its holdings are “bullish” or better. And none are “bearish” or worse.

These companies will thrive if the U.S. government ramps up domestic oil production again. And given the dire situation with our reserves, it’s likely only a matter of time.

So keep these companies in mind during the months ahead.

Good investing,

Briton Hill