Editor’s note: Before we dive into today’s essay, we want to share some exciting news…

This essay is written by our newest analyst, Briton Hill.

Brit’s love of finance began when he noticed his father’s coin collection as a child. After that, he spent years collecting silver coins. Eventually, he cashed out at silver’s peak in 2011.

With some money in his pocket and a growing passion for investing, Brit turned to the stock market. Thanks to his early success as an investor, he soon landed a job at Fidelity Investments as one of the youngest traders in the company’s history.

Brit is an intuitively adept options trader. While at Fidelity, he helped countless mom-and-pop investors make and execute their own trading decisions.

After that, Brit started working with a newsletter guru who helped lead him to his early success. Together, they founded Weber Global Management.

As the president and a partner of Weber Global Management, Brit oversaw a period of incredible growth. The firm’s assets under management climbed from $17 million to more than $150 million.

And most impressive of all… it happened in less than three years.

Brit will now share his market insights with our Chaikin Analytics readers. Starting today, you’ll get to see firsthand how he applies his unique perspective to wealth management…

Folks, I’m thrilled to join Marc Chaikin’s team. And I’m even more thrilled to have the Power Gauge at my side…

You see, I’m currently noticing an opportunity that I don’t think many investors in the U.S. would ever consider. And yet, the Power Gauge is all over it.

The opportunity involves a country that many U.S. investors despise. And as a result, they would never invest in it.

But importantly, this country is also a critical indicator of global economic activity…

As we’ll discuss today, its tech stocks are in the middle of a massive turnaround. One investment has more than doubled since October. But that could be just the beginning…

If you haven’t already guessed, I’m talking about China.

China is the world’s second-largest economy, just behind the U.S. So when the country closed its doors during the COVID-19 pandemic, the entire world took a big hit…

Strict “zero COVID” policies shut down factories across China. And perhaps even worse, they trapped Chinese citizens in their homes.

In turn, the global supply chain was severely disrupted.

Before long, these “zero COVID” policies infuriated a lot of folks. I’m sure you saw the news coverage. Protests broke out all over the country – and some even turned violent.

But the thing is… the Chinese government recently reversed course.

By early December, China modified its plan of attack for COVID-19. It dropped policies that previously prevented folks from even shopping for groceries without a negative COVID-19 test. It reopened the country’s borders. And it did away with quarantine requirements.

Now, China is back. And as I said earlier, the Power Gauge is all over it.

Let me show you what I mean…

KraneShares is a leading provider of China-focused exchange-traded funds (“ETFS”). It offers nine ETFs that track the country’s most important companies across various sectors.

For example, as its name implies, the KraneShares CSI China Internet Fund (KWEB) tracks the country’s tech sector.

These companies are China’s equivalent of our own tech titans like Apple (AAPL), Meta Platforms (META), Alphabet (GOOGL), and Amazon (AMZN). And while you likely haven’t heard of many of them, they’re essential to the daily lives of China’s 1.4 billion citizens.

Take JD.com (JD), for example…

It’s similar to Amazon – but much faster. Over in China, the company is currently working to close the gap between one-day shipping and two-hour shipping. Seriously.

Despite that, the pandemic wreaked havoc on the company’s stock. It lost more than 65% from its February 2021 high through its October 2022 low.

And JD.com wasn’t alone. Many other mega-sized Chinese tech companies suffered similar declines as the country’s “zero COVID” policies continued to crush its economy.

But now, that has all changed. And as a result, the Power Gauge sees an opportunity…

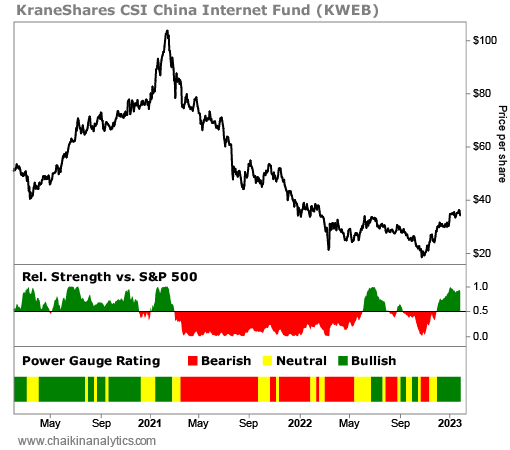

The system flipped to a “very bullish” rating on KWEB in late November. And the Chinese tech stocks it tracks are now outperforming the S&P 500 Index. Take a look…

This is a major shift. So I reached out to KraneShares to get the inside scoop. And fortunately, Chief Investment Officer Brendan Ahern had time to go over it all with me.

In short, Brendan reiterated what the Power Gauge is seeing…

China’s reopening is a massive opportunity for investors. The pandemic lockdowns pushed Chinese stocks into massive “oversold” territory. But now, things are returning to normal.

KWEB has already roughly doubled off its October 2022 low. It currently trades at around $35 per share.

But that doesn’t mean we’ve missed the opportunity. KWEB still has a long way to go to get back to its February 2021 high of more than $103 per share. That’s almost another 200%!

Now, that type of move might not happen overnight. But the bottom line is this…

Chinese stocks represent deep value for investors who can identify the right companies. And the Power Gauge turning “very bullish” on KWEB in late November was no accident.

It’s worth paying attention to what happens in China over the next few months…

China has enough sway in the global economy to swing the markets in either direction. So if a new bull market is beginning there, it could improve fortunes for U.S. stocks as well.

In many ways, it’s the best global reopening indicator we have right now.

Good investing,

Briton Hill

P.S. If you choose to add KWEB or any other ETF to your portfolio, we recommend buying at least a half hour after the market opens. That’s because many niche ETFs are thinly traded early in the morning. So by waiting a bit, you’ll ensure that you get the best possible price.