These days, Wall Street’s old “defensive” playbook is stale…

This playbook was created to cope with rising interest rates and the threat of a recession.

Specifically, when times get tough, this playbook centers around buying defensive sectors like health care, consumer staples, and utilities.

People still need to take care of their health during less-than-ideal economic conditions. And traditionally, demand for consumer staples and utilities is relatively stable as well.

These areas of the market typically aren’t the biggest gainers in boom times. But they also don’t usually go bust as hard as other sectors when economic conditions toughen.

Think about where the market was a year ago…

Uncertainty reigned. So it would’ve made sense for you to consider a defensive posture.

We could’ve invested in the Health Care Select Sector SPDR Fund (XLV), the Consumer Staples Select Sector SPDR Fund (XLP), and the Utilities Select Sector SPDR Fund (XLU). But if we bought equal shares of them a year ago, we would be down about 4% today.

On the other hand, we could’ve bought the Industrial Select Sector SPDR Fund (XLI).

Now, I know what you might be thinking…

Why would we want to own a basket of industrial stocks amid fears of a recession?

After all, investors often associate this sector with factories. When economic conditions weaken, they usually reduce the number of shifts – or even close down altogether. Plus, with high fixed costs, these types of companies aren’t usually as profitable in tough times.

And yet, if we bought XLI a year ago, we would be up around 14% today. That isn’t as good as the broad market over that span. But it’s a lot better than the old defensive playbook.

In other words… the old defensive playbook isn’t cutting it anymore.

Fortunately, as I’ll show you today, the Power Gauge is our key to rethinking what works…

In August 2022, I discussed the Global X U.S. Infrastructure Development Fund (PAVE).

PAVE’s portfolio is full of industrial stocks. The Power Gauge ranked the fund as “very bullish” at the time. And a little more than a year later, our system holds the same grade.

You’ll also recognize the relevant word in the fund’s name – “infrastructure.”

Infrastructure isn’t as hot as “artificial intelligence” in investors’ minds right now. But at the end of the day, we can lump both topics together using another label…

Secular growth.

Companies involved in secular-growth trends do things that need to be done. And more to that point today, we’ll keep doing these things even if the economy weakens from here.

That’s a lot different than the cyclical growth we normally associate with industrials.

I’m sure you’ve heard all about the merits of investing in artificial intelligence (“AI”)…

This powerful, technology-infused trend is carrying us into the future. And the Power Gauge is “very bullish” on the Global X Artificial Intelligence & Technology Fund (AIQ) right now.

But the less-discussed case for infrastructure is also compelling…

If you drive, you know what I mean. The country’s roads, bridges, and highways are in rough shape. They’ve been deteriorating for years. And they need immediate attention.

Even if we enter a recession, those needs won’t go away. We’ll keep advancing AI technology in the years ahead. And we’ll keep improving our infrastructure as well.

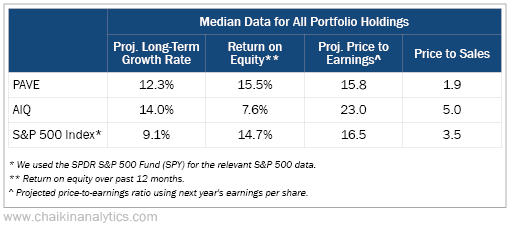

The table below shows why AI and infrastructure both belong in a secular-growth portfolio…

First, look at how cheap infrastructure stocks are in comparison to AI stocks. PAVE’s price-to-sales (P/S) ratio of 1.9 is a lot lower than AIQ’s P/S ratio of 5. You can also see that infrastructure stocks are producing a market-beating return on equity, while AI stocks aren’t.

Infrastructure has better here-and-now fundamentals. But at the same time, AI supports bigger dreams. That’s evident through AIQ’s better projected long-term growth rate.

In the end, both infrastructure stocks and AI stocks belong in a secular-growth portfolio.

So if you’re worried about the threat of a recession and want to protect your wealth…

Don’t follow the old defensive playbook of utilities, consumer staples, and health care. Use the Power Gauge to find the best ways to profit in secular themes like AI and infrastructure.

Good investing,

Marc Gerstein