I’m glad the Power Gauge is here to protect me… from myself.

You see, I’m a happy Spotify Technology (SPOT) premium user. And every now and then, I think it would be a good idea to own the stock as well.

Objectively, I realize that “happy customer” doesn’t necessarily equal “happy stockholder.”

But I’m only human.

So I feel that being a happy customer should count for something. Maybe it could at least be an analytical starting point.

In February 2022, I wanted to buy Spotify for the first time…

I won’t go down a political rabbit hole today. It really doesn’t matter which side you’re on.

But back then, I respected the company’s refusal to cancel controversial podcast host Joe Rogan. And I thought the ensuing public backlash might provide a buying opportunity.

Ultimately, though, I’m glad the Power Gauge protected me from making that mistake. As I said at the time, I decided to pass because Spotify’s Power Gauge rating was only “neutral.”

As it turns out, I was right to let the Power Gauge stand in my way…

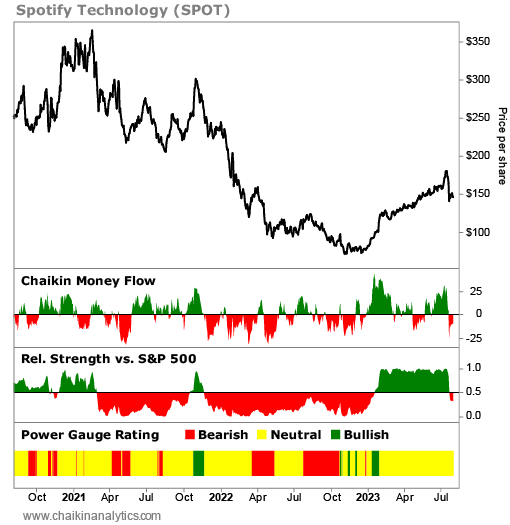

Through the rest of 2022, Spotify fell more than 50%. On the other hand, the benchmark S&P 500 Index only lost around 14% over the same period.

But then, Spotify’s stock tempted me again a couple of weeks ago…

From the end of 2022 through July 24, Spotify turned things around. Its stock soared 107%. That crushed the S&P 500. The index was only up about 19% over that span.

Then, before the market opened on July 25, Spotify reported its second-quarter results.

The report included a lot of good news. For example, Spotify’s subscriber base is growing briskly…

In the quarter, the company had 551 million monthly active users. That was 21 million users above what it expected. And it was 27% better than a year earlier.

Better still, Spotify had 220 million paying subscribers in the quarter. That was 3 million subscribers more than it expected. And it was 17% better than the same quarter in 2022.

The company is also gaining ground with the “Generation Z” crowd. These digital natives, who were born roughly between 1996 and 2010, will be around – and spending – for a long time.

In my opinion, Spotify is smart to capitalize on this part of its audience. And based on all those positives, I decided to take another look at the stock in the Power Gauge.

It’s a good thing I did. The Power Gauge remains stuck in “neutral” on Spotify today.

Perhaps that’s OK…

After all, “neutral” is better than “bearish” or “very bearish.” And according to our research, stocks with those two ratings perform much worse than stocks with “neutral” ratings.

But there’s logic behind our choice to color-code the Power Gauge rankings as green, yellow, or red…

It’s like a traffic light. Yellow doesn’t mean “stop.” We can proceed. But we need to be careful.

When I looked closer at Spotify’s yellow signal, I saw a big concern. And so do other investors…

Since the company reported its second-quarter results, its stock is down about 11%. Meanwhile, the S&P 500 is roughly breakeven over that period. Take a look…

Spotify attracts a big – and growing – audience in a competitive streaming world. But the company continues to lose money…

Its earnings before interest and taxes (“EBIT”) turned positive in 2021. But it quickly fell back into the negative range. And it remained negative in the latest quarter.

The company’s latest EBIT loss was $112.4 million.

That was better than its $247.3 million EBIT loss in the same quarter of the previous year. But it’s still well below the 2021 second quarter’s $14.2 million EBIT profit.

Of course, Spotify isn’t the first “digital growth” story involving losses. The Power Gauge can handle that if other factors line up in the company’s favor.

Specifically, in this case, the key is whether Spotify has a credible path to profitability. And management clearly wants to get there…

That’s why it’s starting to raise subscription prices. As a happy premium user, I’ll pay the higher costs. But we’ll have to wait and see how many others feel the same way.

The company is also getting tough on controlling costs…

It probably can’t do much about higher music-royalty fees. But it can do a lot about poor performing podcasts…

For example, in June, Spotify cut ties with the Royal Sussexes (Prince Harry and Meghan). Meghan’s Archetypes podcast was well-reviewed. But the couple didn’t deliver enough content.

In the end, I see why the Power Gauge is flashing its yellow caution signal…

There are some things to like about Spotify today. But there are also reasons to be careful.

I’m all about a sensible process. And I’m glad the Power Gauge is part of my process.

Thanks to our system, the real me will keep overruling the emotional investor in the mirror – at least for now.

When it comes to Spotify, I’ll stick with listening over buying today.

Good investing,

Marc Gerstein