Trying to figure out the right value of the S&P 500 Index is tough these days…

The benchmark index is down more than 24% from its early January peak. So at first glance, you might think that means it’s a good deal right now.

But by some measures, it’s still significantly overpriced…

For example, S&P Global data shows that “operating” earnings per share (“EPS”) for S&P 500 companies rose 771% from the end of 1988 through March 31 of this year. (Operating EPS is simply earnings that exclude unusual gains or losses.)

Over that same period, the S&P 500’s price rose 1,531%.

If the index would’ve simply climbed in step with operating EPS, it would be at about 2,420 today. That’s roughly 34% below its present level of around 3,640.

Many Wall Street analysts are busy today debating the question, “Is the market priced fairly or not?” But folks, that misses the most important hurdle that investors face right now…

Put simply, investors are dealing with conditions they haven’t seen for roughly 40 years. The era of passive gains is over. And investors who don’t accept that will soon regret it.

Let me explain…

The critical piece of this puzzle is interest rates. And more specifically, it involves their relationship to what’s known as the “equity risk premium”…

Financial theory tells us to expect stock returns that exceed what we expect to return from so-called “risk free” securities – like U.S. Treasury bonds.

Think of this premium as a way to entice you to bypass the risk-free securities and invest in riskier stocks.

This is an important number. Financial “eggheads” swear by it. And with some simple back-of-the-envelope math, we can use this number to get a glimpse into the market’s future…

To make it easy to follow, we’ll just flip the S&P 500’s price-to-earnings (P/E) ratio. That turns it into the earnings-to-price ratio – or “earnings yield.” And it sets us on a path to directly comparing stocks with risk-free assets like U.S. Treasury bonds.

We’ll use earnings yield plus “dividend yield” to get the “expected stock return.” And for the expected return of risk-free securities, we’ll use the 10-year U.S. Treasury note’s yield.

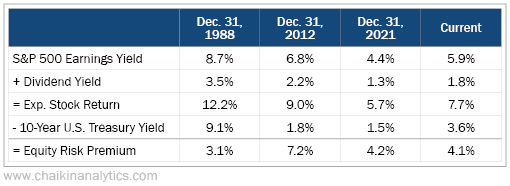

Now, we want the equity risk premium to be as high as possible. (As you can see below, that’s simply the expected stock return minus expected risk-free return.)

No firm rule exists for what we should consider a “good” equity risk premium. Generally, though, it’s assumed that something between 5% and 5.5% is reasonable.

In the following table, you can see how things have changed over time…

The 3.1% risk premium at the end of 1988 was too low. That could’ve turned out catastrophic for stocks.

But over the next three-plus decades, interest rates – and by extension, the risk-free rate – plummeted spectacularly. The 10-year U.S. Treasury note’s yield dropped from 9.1% at the end of 1988 all the way down to 1.5% at the end of 2021.

So instead of a catastrophe, that falling-rate market acted as a massive tailwind for the equity risk premium on stocks…

Stocks soared for essentially three-plus decades. Sure, there were some hiccups along the way – like the dot-com bust and the housing crash. But as I said earlier, the S&P 500 surged more than 1,500% from the end of 1988 through March 31 of this year.

Notice in the table above that the equity risk premium was darn high just after the housing crash in 2012. That was one of the best times to buy stocks in decades. And of course, it paid off for investors. The S&P 500’s rise over the following decade was historic.

But now, the S&P 500 is back to a skimpy equity risk premium. As you can see in the table, it’s now well under the “reasonable” 5% threshold.

That leaves us with two possible outcomes…

First, interest rates could go back to falling – like they did for decades leading up to earlier this year. Or earnings yields could fall (meaning, P/E ratios could rise) – just like they did in 1988 and beyond.

The problem is… neither outcome is likely. Knowing that, we’re in a tough spot today…

Even after the recent round of hikes, interest rates are still very low. Inflation remains a big problem, so even higher rates are likely in the months ahead.

The earnings side poses a significant challenge, too. I wouldn’t count on S&P 500 companies as a whole to deliver enough earnings growth to significantly raise earnings yields.

Put simply… most investors have never experienced a market environment like this one.

Rates dropped for more than 30 years. And stocks responded accordingly, going up and up.

But today, the equity risk premium is narrow. As a result, stocks are basically in limbo.

Investors hoping to overcome this harsh reality will need a different strategy. The passive-investing era of “just put money in the market and hope for big returns” is over.

Instead, it’s time to get active.

Good investing,

Marc Gerstein