You’ve likely heard by now that McDonald’s (MCD) is changing its burgers…

Among other things, the fast-food giant is switching to brioche buns for its signature Big Mac. It will also cook the patties in smaller batches. And it’s tweaking many ingredients.

In short, McDonald’s is doing all these things to try to create a “fresher” burger.

This isn’t the first time the company has refreshed its menu, of course. Through the years, it has tried everything from Angus Third Pounders and “all-day breakfast” marketing campaigns to the McCafé concept that led to a flourishing coffeehouse-style brand.

Still, the coming changes to its burgers are big. And folks, this move is a gamble…

Whenever a company messes with a beloved consumer product, it risks creating the next “New Coke.” That was Coca-Cola’s (KO) failed attempt to reformulate its product in 1985.

So with that in mind, let’s look closer at McDonald’s today…

The stock fell about 17% from early July through mid-October. But it has popped higher since then. That makes right now the perfect time to use the Power Gauge to dig deeper…

Regular Chaikin PowerFeed readers know that the Power Gauge is our 20-factor investing model. It covers four main categories – Financials, Earnings, Technicals, and Experts.

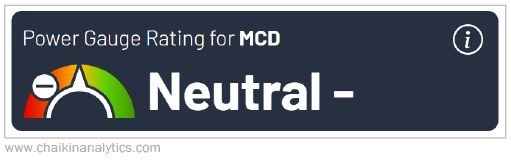

The Power Gauge weighs the 20 factors using a proprietary system based on Chaikin Analytics founder Marc Chaikin’s decades of Wall Street experience. And in the end, it produces a “bullish,” “bearish,” or “neutral” rating for every stock in its universe.

Beyond that, the “neutral” category is split into three different levels…

- Neutral

- Neutral+

- Neutral-

Notably, McDonald’s receives a “neutral-” rating today…

Next, let’s look at the one-year chart. Notice the pullback and rally I mentioned earlier…

Put simply, McDonald’s has struggled to keep up with the broad market this year.

The stock is up roughly 7% in 2023. But the S&P 500 Index has soared around 20%. This underperformance is clear in the “relative strength” panel below the main chart.

McDonald’s currently earns “bearish” grades in the Earnings and Technicals categories. And worse still, the company receives a “very bearish” rating in the Financials category.

When the Power Gauge puts all the data together, McDonald’s would get a “bearish” overall rating. But as anyone who trades stocks knows… the trend is still the trend.

Sometimes, “bullish” stocks go down. If the trend turns far enough against these stocks, the Power Gauge flags them with a “neutral+” rating.

Other times, “bearish” stocks go up. If the trend moves far enough in these stocks’ favor, the Power Gauge flips to a “neutral-” grade.

That’s exactly what we’re seeing with McDonald’s today…

The gray dotted line on the previous chart is the stock’s long-term trend line. And as you can see, the latest rally for McDonald’s pushed it above this line in mid-November.

In other words, the stock is currently above its long-term trend line.

In response, the Power Gauge bumped it to a “neutral-” rating. That’s how we know that our system acknowledges both the stock’s trend and its lackluster grades at the same time.

McDonald’s could be in the early stages of a turnaround. As we’ve discussed today, the fast-food giant is in the middle of a major revamp. That move could be good for the long term.

But the Power Gauge urges us to be careful. So keep McDonald’s on your watch list for now.

Good investing,

Vic Lederman