Folks are vacationing and dining out like there’s no tomorrow…

Or at least like a recession isn’t looming.

Specifically, the industry that includes hotels, restaurants, and leisure activities is strong…

The industry’s Power Bar ratio features 62 “bullish” or better companies right now. And only four companies are “bearish” or worse. (Learn more about the Power Bar ratio right here.)

That might surprise you for a couple reasons…

First, many folks still expect the Federal Reserve’s aggressive interest-rate hikes to hurt the economy. And secondly, massive layoffs are happening – especially in Big Tech.

Perhaps people will soon shift gears and stay home. Or maybe the economists are wrong.

Today, we’ll look to get some clarity into this situation…

We’ll use one reliable indicator to “check the pulse” of the travel industry. And by combining it with the Power Gauge, we’ll try to squeeze some answers out of Mr. Market…

Our reliable indicator tracks consumer sentiment. And it’s simple to understand…

Cruises.

When people are healthy and optimistic, they go on cruises. And when they’re fearful and pessimistic, they don’t.

Of course, the COVID-19 pandemic hit cruise operators especially hard. The entire industry shut down…

You likely recall the horror stories of folks stuck on cruise ships in the COVID-19 pandemic’s early days. Many ships couldn’t even dock due to fears that the virus would spread.

Most cruise operators had to borrow heavily just to stay in business. So as a result, they became financially weaker.

But as the economy reopened, cruise bookings came roaring back. Many folks who were stuck in their homes for too long rushed to get back on the open seas.

By this past November, cruise bookings topped their pre-pandemic levels. In particular, Black Friday and Cyber Monday saw especially brisk activity.

And November isn’t even part of the so-called “wave season.” That usually happens at the start of a new year. Cruise operators lure potential customers with the best discounts.

So with all that in mind, let’s get the Power Gauge’s take on the three major cruise lines…

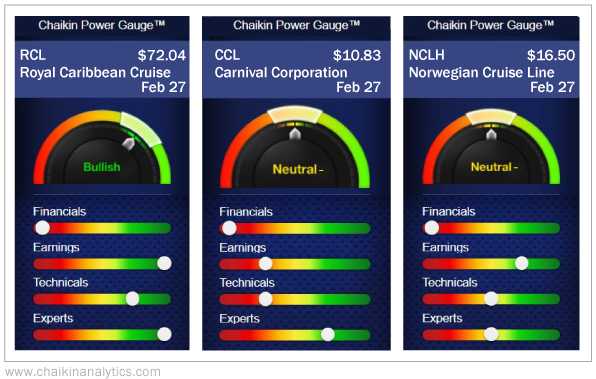

As regular readers know, the Power Gauge weighs 20 factors. These factors fit into one of four categories – Financials, Earnings, Technicals, and Experts. And in the end, the system generates a “bullish,” “neutral,” or “bearish” rating for each stock.

Today, the Power Gauge gives Royal Caribbean (RCL) a “bullish” ranking. But it’s sending a different message about Carnival (CCL) and Norwegian Cruise Line (NCLH)…

Despite the favorable market sentiment, these two cruise operators have many “bearish” or “very bearish” factors. And overall, they’re both ranked as “neutral-” right now…

The Financials category is “very bearish” for all three companies. These cruise operators all carry significant debt. That’s evident through their high long-term-debt-to-equity ratios.

The Earnings category shows the beginnings of their comebacks…

Royal Caribbean and Norwegian have reported better-than-expected earnings in recent quarters. Carnival is the weakest of the bunch, with a “bearish” grade in that category. But even it’s showing an upward earnings trend.

The Technicals and Experts categories help us see what certain groups of investors expect in the future. This is where Royal Caribbean stands above its two rivals today…

The company is progressing alongside the positive industry trends. It has “bullish” or better grades in these two categories. And it beats Carnival and Norwegian in both of them.

The bottom line is simple…

The cruise industry is moving in the right direction. But don’t just buy any cruise operator.

Right now, Royal Caribbean is the strongest of the industry’s big three companies. It has a “bullish” rating. And it should continue to perform well in the months ahead.

So if you want to dabble in this space, consider giving Royal Caribbean a closer look.

Good investing,

Marc Gerstein