John Bogle built a naysaying empire…

In 1974, Bogle launched Vanguard. As the decades passed, the company grew into a financial-management titan. And its pioneering approach to investing buoyed its success…

I’m talking about “indexing.”

Put simply, indexers don’t think investors can consistently make good choices with their own money. They don’t believe folks can keep choosing the right stocks over the long run.

So Vanguard convinced large numbers of investors to stop trying and just buy everything.

In Bogle’s mind, that meant “buy the market.” Or more specifically, it meant, “buy index funds.” That way, investors could buy into the S&P 500 Index with one trade instead of 500.

As I said, using this approach, Vanguard became one of the world’s largest financial-management firms. An entire empire of indexers told investors not to think for themselves.

However, that brings us to this approach’s major flaw…

Suppose you want to consider economic weakness and high fuel prices. They’re both real problems today, after all. So maybe you don’t want to own Ford Motor (F) or FedEx (FDX).

“That’s too bad,” the indexers would say. “Regular humans like you can’t decide such things. Just pipe down and own those stocks along with the rest of the S&P 500.”

Folks… that’s wrong.

As an investor, thinking is good. You can – and should – avoid stocks that will likely perform poorly. And as I’ll explain today, it’s easy to beat Bogle’s naysaying empire on its own turf…

It all starts with a sensible stock-selection method…

Don’t let the naysaying empire pull the wool over your eyes. And don’t just flip coins, read tea leaves, act on gossip from around the water cooler, or follow any hunches, either.

As regular readers know, our 20-factor Power Gauge system ranks thousands of stocks using objective data. It combines metrics like quality, sentiment, and technical analysis.

In short, you can use the Power Gauge to make sensible, profitable investment choices.

But there’s more…

The Power Gauge also ranks exchange-traded funds (“ETFs”). These ratings combine the overall rankings of the stocks held within them with a specially designed technical ranking.

Importantly, this is how we can gain an edge over Bogle’s naysaying empire…

We don’t need to just blindly buy into the SPDR S&P 500 Trust (SPY). We can do better.

We can eliminate the bad parts.

You see, the broad market is made up of 11 different sectors. And investors like us can easily invest in each sector using ETFs managed by State Street Global Advisors.

To eliminate the bad parts, we just need to buy the sector-focused ETFs with “neutral” or better rankings in the Power Gauge. And after we’ve done that, we can re-examine the ETF rankings and adjust our portfolio as needed once per quarter (or every 13 weeks).

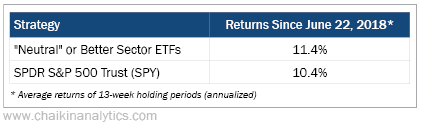

Here’s how this approach would’ve worked out over the past four and a half years…

You’ll notice that our analysis started on June 22, 2018. That’s when the current setup of sector-focused S&P 500 ETFs began. So it’s a good “line in the sand” for tracking returns.

By just avoiding the weakest sectors every quarter since then, our annualized performance would’ve beaten the indexers in SPY by one percentage point.

That might not seem like much at first. But keep two things in mind…

First, Vanguard made big bucks by convincing folks that nobody could beat the market.

Also, remember that this period included the old “everything bull market,” which was generated by decades of easy money and little or no inflation. That era is now over.

The new era will likely feature “rolling” booms and busts. As a result, we should expect much larger differences between strong and weak sectors in the months and years ahead.

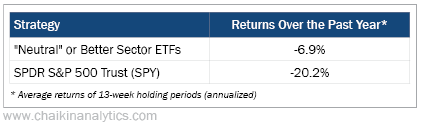

To that point, here are the returns for this approach over the past year…

Now, as you can see, this approach still would’ve lost money during this tough period. But it significantly outperformed the indexers. It beat SPY by more than 13 percentage points.

In the end, I hope my message is clear…

It doesn’t take much effort to beat Bogle’s naysaying empire. And you can do that on its own turf – using the sector-focused ETFs with the most favorable Power Gauge rankings.

You can build a smarter version of the overall market with just a few trades every quarter.

Good investing,

Marc Gerstein

Editor’s note: The Power Gauge pinpoints which stocks and ETFs are “bullish” or “bearish” every single day. And in our Power Gauge Report newsletter, we take it a step further…

In short, every month, Chaikin Analytics founder Marc Chaikin does all the hard work. And he pinpoints the best ways for our subscribers to potentially double or triple their money.

Right now, we’re offering a special deal for all Chaikin PowerFeed readers. You can receive a full year of all the research in Power Gauge Report for just $49. Click here for all the details.