Your suspicions are correct…

The U.S. stock market is a wildly different animal than it was even just three months ago. That’s true in terms of both the fundamentals and the technicals.

Behind this shift is a financial story that no one is telling right now. And it’s keeping me up at night.

I can see it in a way that most everyday investors can’t. That’s because my Power Gauge system is picking up on it…

It’s showing an extreme setup I haven’t seen in years. Something like this hasn’t happened since well before the COVID-19 crash in March 2020.

Simply put, we’ve been on an easy ride with a clear investing road map for the past couple of years. But the road map has gotten much harder to read in recent months…

And now, I’m worried that millions of U.S. investors are about to drive straight off a cliff. They’ll make every investing mistake in the book – including missing out on one of the biggest wealth-building opportunities in recent history.

In short, a big shift is coming within the next 90 days. That’s why I’m writing to you today…

However, you’ve likely missed what’s happening if you’ve only followed the “broad market.”

Most folks right now are worrying about the next big market crash. They’re scared that it will come soon.

But if you’re looking at the market like I do – and like a hedge-fund manager would – you know the real answer…

It’s already happening.

You see, most industries have already crashed. Some of these crashes started happening as far back as February 2021. And when it comes down to it, almost all the industries in the market have already crashed 20% or more within the past year.

For example, the biotech industry crashed 47%. And retail stocks crashed 25%.

That’s not all, either – not by a long shot…

The software industry crashed 23%. Health care services and health care equipment stocks both crashed more than 20%. And transportation stocks crashed 20%.

Even defense-related companies and oil and gas stocks – which are both up a lot recently – crashed into a bear market within the past year. Oil and gas stocks fell as much as 32%, while defense stocks were down 21% at one point.

The tech crash is particularly interesting…

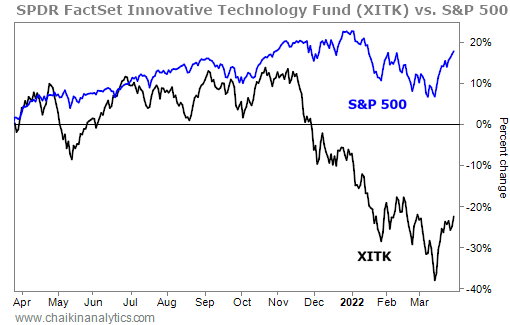

So-called “innovative technology” stocks crashed as much as almost 40%. Just look at what happened to the SPDR FactSet Innovative Technology Fund (XITK) in late November…

Beloved stocks in this industry took a very publicized beating. Look at what has happened to Cathie Wood’s ARK Innovation Fund (ARKK). It’s the poster child for investing in “overpriced” tech stocks.

And that was before the broad market took a nosedive in January and February…

In other words, this corner of the market started crashing long before folks were scared about a broader crash. No one at the time feared the war in Ukraine or anything like that.

Now, just a few months later, it’s a much different story. The S&P 500 Index tumbled into a correction. And since then, we’ve seen heightened volatility and erratic movements in the market.

Meanwhile, hundreds of stocks in the weakest industry groups have been suffering big crashes for more than a year. The only difference is that now the losses are becoming widespread enough to get the attention of the mainstream media.

Again, the overall market had dropped as much as 13% earlier this month before bouncing back over the past few weeks. It’s still about 3% below its all-time high.

But if you were to zoom in, you would see that more than 60% of the industries we monitor at Chaikin Analytics have plummeted between 20% and 50% since February 2021.

That’s a market crash, my friends. It just doesn’t look like the ones you’re used to.

It’s called a “rolling crash.“

A rolling crash doesn’t happen in an instant. It can be much worse. It spreads across the market over time. It sends specific industries crashing before spilling over into the next.

It acts like a snowball. It gets bigger and picks up speed as it races down the hill. And the only way to not get run over by the snowball is to know where the crash is rolling next.

Have other rolling crashes occurred in the past? Absolutely.

The last rolling crash happened in late 2018.

That year, investors were worried about war with China. And talks of a big interest-rate hike led many folks to believe the end was near. Sound familiar?

Stocks were still chugging higher overall back then. But the rising index failed to warn investors that something serious was bubbling under the surface…

You see, the average stock in the index was down 18%. So it’s not surprising that the market soon tumbled into a downturn.

The 2018 rolling crash spread from the banking industry… to automakers… to raw materials… to the semiconductor industry…

And it all culminated in a big, market-wide plunge. The S&P 500 nearly entered bear market territory on Christmas Eve.

I called it the “Christmas Eve Massacre” at the time. For investors with money in the wrong stocks, it felt like there was blood in the streets.

And again, you might notice that it all sounds eerily similar to what we’re seeing today. Geopolitical fears and interest-rate rumors are swirling. The parallels are quite clear when you analyze the market on an industry level.

Another rolling crash happened on a smaller scale in 2015. A “flash crash” occurred in Chinese stocks. Then, the price of oil plunged.

And if you would’ve zoomed in to the industry level, you would’ve seen how the rolling crash spread from industry to industry in just less than a year…

The mining industry collapsed 58%. The crash then rolled into the entire oil and gas industry, which plunged 55%.

Then, it rolled into a 47% crash in the biotech industry… a 40% crash in the pharmaceuticals industry… and a 30% crash in the health care industry.

In the end, the S&P 500 itself only dropped 15%. But the months leading up to that were still a terrifying, painful time for investors. Many folks were blindsided by massive losses.

And a similar phenomenon happened in 2011. Back then, the markets quickly plunged after Standard & Poor’s downgraded the credit rating of the U.S. from the coveted “AAA” level.

I’ve seen this period called “the bear market nobody talks about”…

Overall, the S&P 500 crashed 19%. But before and after the broad market fell, a far more devastating rolling crash spread across specific industries…

The banking and insurance industries both crashed more than 30%. Meanwhile, industries like transportation, biotech, and retail didn’t peak until as much as five months later. And then, they crashed 20% to 30%.

It’s crazy to think about… but even an investor in his or her early 30s, who is still just testing the waters, has already lived through four rolling crashes.

They’re a natural result of the stock market growing bigger and more complex.

The good news is that you can stop worrying about the day of the next big crash…

It’s already here.

And it has already sent a wave of losses through 60% of the market’s industries.

The bad news is that you have a very narrow window of time to prepare for what comes next. I’ll say it up front… Things are about to get a whole lot worse for some stocks.

But at the same time, not everything will crash. Some stocks are poised to deliver gains that will rival – and even exceed – what we’ve seen over the past couple of years.

In fact, one industry in particular is still churning higher in spite of the recent volatility and rolling crashes. And I just shared one of my favorite stocks within this industry with everyone who tuned in for my special online event last night.

Plus, I discussed the No. 1 worst stock to own right now. It’s a soon-to-fall pandemic stock that many investors have overlooked. But you can’t afford to ignore what the data shows us. If you’re holding shares, you’ll want to unload them immediately.

Now, as I just said, this event happened last night. But it’s still not too late for you to get this information before the markets open today. Watch the full replay for free right here.

Good investing,

Marc Chaikin