Folks, we’re unquestionably seeing bull market signs all around us…

In fact, you’ve likely noticed the past few Chaikin PowerFeed essays have led with a similar message. We want to make it clear…

The market is full of opportunity right now.

But that doesn’t mean every sector and subsector is doing well…

Ironically, one subsector designed to protect your money is actually destroying investors’ wealth today. It’s down around 31% in the past six months alone. And its bigger brother is down roughly 21% over the same span.

Those losses are huge compared with the broad market. The S&P 500 Index has gained more than 13% in 2023. And the tech-heavy Nasdaq Composite Index is up about 35%.

Avoiding a sector-specific wipeout is critical for investors…

Put simply, folks can find tremendous upside potential if they know where to look right now. But a misstep into the wrong sector or subsector could lead to serious losses.

Fortunately, avoiding those missteps is easy with the Power Gauge. So today, let’s take a closer look at the subsector that’s currently destroying investors’ wealth…

Folks, when it comes to six-month performance, one subsector is clearly the worst. And yet, it could already be fading from your memory…

You see, the “run on the banks” from just a few months ago has already moved out of the news cycle. But the financial sector as a whole is still hurting…

The Financial Select Sector SPDR Fund (XLF) is still down more than 4% this year. And that remains the case even as the Federal Reserve starts to loosen its grip on interest rates.

When we dig a level deeper into the subsectors, we come across a clear loser…

Regional banks.

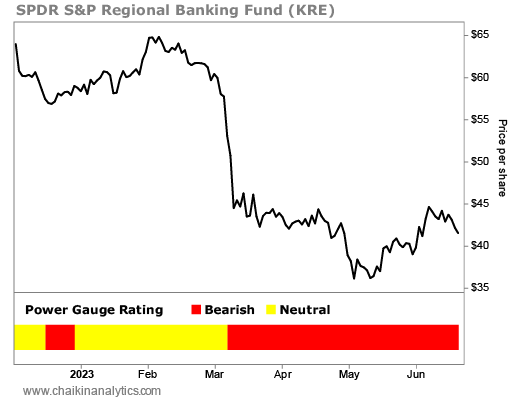

In the Power Gauge, we measure that subsector using the SPDR S&P Regional Banking Fund (KRE). And it’s easy to see on the chart that things are still seriously wrong. Take a look…

Regional banks have gotten absolutely wiped out this year.

But fortunately, as you can see in the bottom panel of the chart above, the Power Gauge noticed the change before it happened. It first flashed a “bearish” warning last December.

Today, the subsector still holds a “bearish” rating in the Power Gauge. And none of the 142 rated stocks within this exchange-traded fund earn a “bullish” or better rating today…

Its bigger brother, the SPDR S&P Bank Fund (KBE), is nearly as bad. It holds just seven “bullish” or better stocks. And 56 of its holdings are currently “bearish” or worse.

Folks, it’s ironic…

Banks are supposed to protect our wealth. But they’ve destroyed a lot of investors’ wealth so far this year. And as we’ve seen today, they’re still acting as wealth destroyers.

Will things stay that way forever?

Absolutely not. The market will eventually rotate back toward financials.

But today, we’re nowhere near that point…

Large banks are struggling. And the smaller players, the regional banks, are as “bearish” as it gets.

It might seem obvious. But I recommend you avoid this space until further notice.

Good investing,

Marc Chaikin