Marc Andreessen is one of the greatest technology gurus of all time…

Andreessen graduated from the University of Illinois in 1993. During his time at the school, he completed two internships at computer giant IBM’s (IBM) location in Austin, Texas.

This experience kick-started Andreessen’s long, profitable career in the tech world…

While Andreessen was still at Illinois in 1993, he and a fellow programmer started developing the first widely used Internet browser. A year later, their browser hit the mainstream as “Netscape Navigator.”

Soon, Andreessen’s face was everywhere. And by the end of the decade, he was rich…

Internet pioneer AOL bought Netscape for more than $4 billion in 1999.

But Andreessen was far from finished…

In the mid-2000s, he started investing in tech startups. And in 2009, just after the financial crisis, he and business partner Ben Horowitz launched an eponymous venture-capital firm.

Andreessen Horowitz funded many tech powerhouses that you know and love today. Its investments over the years have included Skype, Facebook, Groupon, Pinterest, and Twitter.

Andreessen clearly knows a thing or two about tech. And in 2011, on the cusp of the greatest bull market ever, he made a bold statement…

Software is eating the world.

Andreessen meant that the new-world tech titans were crushing the old world of brick-and-mortar stores. These businesses were the future. They would lead investors to huge returns.

And he was spot on. Think about it…

Netflix (NFLX) killed video-rental stores like Blockbuster. Among other things, Alphabet (GOOGL) crushed direct marketers. And Amazon (AMZN) has all but eliminated bookstores.

But that’s the problem…

Just about everyone knows the major tech stories these days.

It feels old hat – especially to investors. People who want to impress their friends, family members, or co-workers with a great stock they found aren’t going to talk about Amazon.

To make matters worse, we all just lived through the latest “tech wreck”…

The Nasdaq Composite Index lost 36% of its value from November 2021 through the end of last year. And many individual stocks suffered worse – even tech juggernauts like Amazon.

Sure, tech stocks are roaring back in 2023. The Nasdaq is up around 31% from its most recent low. And the index recently crossed 13,500 for the first time since April 2022.

But when it comes to this massive – and obvious – opportunity, many investors still aren’t considering it. Despite this rally, many tech stocks remain far below their peaks today.

These investors are making a big mistake.

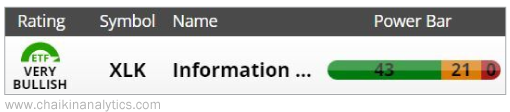

You see, the Power Gauge is full-tilt “very bullish” on tech today. Take a look…

That’s the breakdown of the Technology Select Sector SPDR Fund (XLK). It’s one of the primary ways we measure the broad performance of tech stocks in the Power Gauge.

And as you can see, this exchange-traded fund doesn’t currently have any “bearish” or worse stocks. In fact, the vast majority (43) of the stocks earn “bullish” or better ratings.

So as Marc Andreessen said more than a decade ago, software is eating the world. And it’s also true that this story feels old hat to investors today.

But don’t let those two truths lead you to get left behind…

Tech stocks are surging this year. And the Power Gauge remains “very bullish” on the space.

Good investing,

Pete Carmasino