When a recession hits, being “good” isn’t good enough…

Good dividend-seeking investors focus on strong companies. They want to park their money in businesses that can avoid cutting dividends, even when profits fall.

Many such opportunities exist. The Vanguard Dividend Appreciation Index Fund (VIG) is filled with them. But VIG’s yield is only 1.95%.

That’s not good enough. You have to do better.

The iShares Select Dividend Fund (DVY), a not-so-glamorous recession fortress, is serving investors well. It might seem like the superior option.

DVY yields 3.05%. But so far in 2022, its total return (including price change and dividends) is -3.2%.

Obviously, we want to do better than -3.2%. That’s not always possible in a bear market. But over time, opportunities to reinvest dividends can add up.

At any rate, DVY has been far better than VIG. The latter’s year-to-date return is roughly -16.3%. Plus, it has a smaller dividend than DVY… So it will have a much harder time catching up.

The SPDR S&P 500 Fund (SPY) fared even worse. Its yield is only 1.54%. And its year-to-date return is around -19.8%.

All of these are good funds. But none of them are good enough. We need to do better.

As you know, we’re on the verge of a recession. That means serious pain ahead for returns – and even lower yields.

Fortunately, we can do better. All it takes is letting the experts trade a strategy you might not have heard of…

The Amplify CWP Enhanced Dividend Income Fund (DIVO) is a “buy write” exchange-traded fund (“ETF”). That means it also sells call options, which give the buyer the right to buy the stock from the ETF at a pre-specified price (the “premium”) by a specified date. (More on this shortly.)

DIVO seems better-positioned to withstand further market and economic deterioration. It yields 5.19% today.

This is not a high-risk “junk dividend” fund. In fact, VIG also holds 57% of DIVO’s portfolio. We’re talking about household names like Procter & Gamble (PG), Johnson & Johnson (JNJ), and McDonald’s (MCD). And the rest of the companies are of similar quality.

DIVO is an actively managed ETF. Its managers aim for a 2% to 3% yield from its good-quality holdings.

In terms of its call options, DIVO gets to keep this money if an option expires worthless. The same goes if the stock stays below the “strike price” – the price at which the call can be exercised. If the stock rises, DIVO will have to sell for less of a gain than it could have earned by holding.

Either way, the premium counts as income that gets distributed to shareholders. Management aims to distribute enough of this income to add 2% to 4% to the yield. (This is how DIVO produced a 5.19% trailing 12-month yield.)

As we said, DIVO loses money on stocks that fall below option strike prices. But it cushions those losses using the premiums it earns from expired options. And DIVO can use that money to sell new options and collect more premium income – rinse and repeat.

Plus, DIVO pays monthly dividends. That gives shareholders more opportunity to reinvest cash at lower prices. (DVY and VIG each pay dividends only once per quarter.)

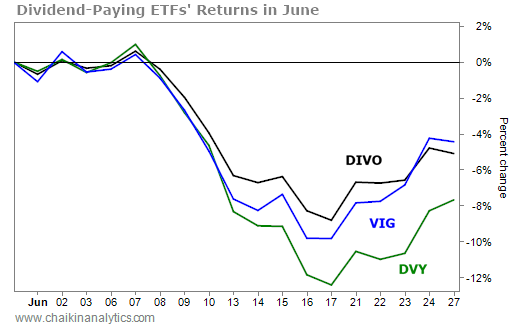

Take a look at what happened during the market’s worst days in June…

DVY, with its riskier companies, was the worst performer. If the market deteriorates further, we can expect this underperformance to continue.

Notice that DIVO lost the least during the worst part of June. And even with the recent bounce back, it matches the higher-quality, lower-risk VIG.

And don’t forget that it does this while maintaining a significantly higher yield… all because of its buy-write strategy.

Now, call writing is a very respectable, risk-reducing way to generate income. But options can be a bit complicated. And there are other, riskier option strategies.

In short, when ignorant investors are careless, it can cost them big. If you’re interested in call writing, DIVO lets you delegate the grunt work to the experts.

Good investing,

Marc Gerstein