One of mankind’s biggest threats comes from within…

This threat is responsible for nearly 3 million deaths each year. And in the U.S. alone, more than 40% of people battle this threat every day. That’s more than 130 million Americans.

If you haven’t figured it out by now, I’m talking about obesity.

I realize that you might not think of obesity as an epidemic at first. But that’s exactly what it is.

Fortunately, we can now fight the obesity epidemic with prescription drugs. And one company is at the forefront of this battle…

This company has treated diabetes for decades – 10 decades to be exact. And in recent years, it discovered that its drugs also help patients lose weight.

But folks, we didn’t need to be medical scientists or doctors to find this company…

First, we just needed to hear about this new weight-loss treatment. Then, we needed to put on our investing caps. And finally, we would’ve seen that the company is publicly traded…

In fact, investors are booking big profits with the company’s stock. It’s up around 360% over the past six years. Since last September alone, it’s up roughly 75%.

The Power Gauge has tracked this story the entire way. And as I’ll show you today, our one-of-a-kind system expects more upside moving forward for this company…

In short, the company is Denmark-based drugmaker Novo Nordisk (NVO).

Novo Nordisk currently treats Type 2 diabetes with Ozempic. This once-a-week injection helps regulate a patient’s blood sugar.

Another recently approved form of the drug is called Rybelsus. It’s a once-daily tablet.

The active ingredient in both Ozempic and Rybelsus is “semaglutide.”

The U.S. Food and Drug Administration (“FDA”) approved semaglutide in higher doses for weight loss in June 2021. Novo Nordisk renamed this version Wegovy. And since then, ongoing approvals have opened new markets and patient profiles.

Wegovy and Novo Nordisk’s other weight-loss treatments are driving the company’s stock higher. And its decadeslong fight against diabetes is still boosting business as well.

It’s a win-win situation for investors.

When you first hear about a new idea like this one, head over to the Power Gauge…

Regular readers know our system gives an unbiased take on thousands of companies. It breaks down each company using 20 different factors. And in the end, it produces a single, actionable rating – from “very bearish” to “very bullish.”

With the Power Gauge’s help, the opportunity in Novo Nordisk was crystal clear…

The news about Ozempic’s potential usage for weight loss first broke in 2017. And over the years, the Power Gauge regularly held the stock in high regard.

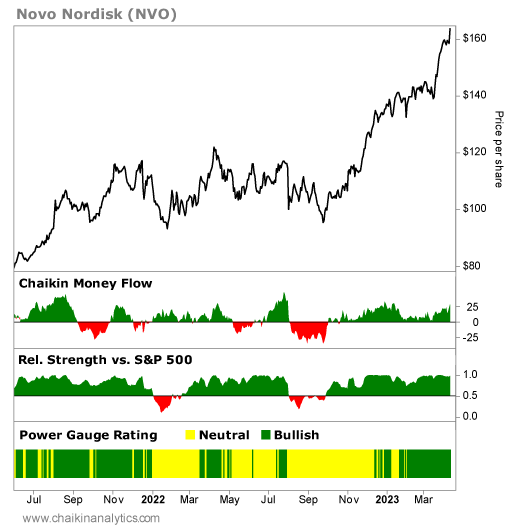

As you can see in the chart below, the Power Gauge has been green (“bullish” or better) for a large part of the past 22 months. You’ll also notice a lot of yellow coloring. In this case, that stands for the positive-leaning “neutral+” rating most of the time. Take a look…

Again, Wegovy received FDA approval in June 2021. At that time, Novo Nordisk traded for about $80 per share. It now trades for around $167 per share.

But it hasn’t always been full steam ahead…

For roughly a year starting in October 2021, the stock traded in a range between $95 and $120 per share. As you know, the market and the economy were in turmoil over that span.

Notably, Novo Nordisk didn’t sell off like many stocks did throughout 2022. And as the market rebounded to start this year, so did Novo Nordisk…

As I said earlier, the company’s stock is up around 75% since last September. And importantly, the Power Gauge remains “bullish” on its prospects moving forward.

My point is simple…

The news about Wegovy became public almost two years ago. The stock has endured some bumps along the way. But for the most part, it has held up well in a volatile market.

And the entire time, the Power Gauge could’ve guided us with its innovative rating system.

Good investing,

Pete Carmasino