The stock market is on a delightful run…

So far this year, the benchmark S&P 500 Index is up around 14%. And the tech-heavy Nasdaq Composite Index has gained roughly 29%.

Looking into the future, I believe we’re in the early stages of a new bull market. And as regular readers know, Chaikin Analytics founder Marc Chaikin feels the same way.

But even in the strongest bull markets… nothing goes up in a straight line.

In fact, we’ve experienced a small pullback over the past week. The S&P 500 is down around 1.3% since last Thursday. And the Nasdaq has dropped about 2% in that span.

That might seem like a bad thing at first. But if you know where to look, pullbacks like the one we’re enduring right now can present great buying opportunities.

That’s why we often focus on strong stocks in strong industries at Chaikin Analytics…

These stocks are in the best position to weather any short-term volatility – and perhaps even thrive from it. And of course, the Power Gauge helps us find these opportunities.

Today, I’m going to give you a rare “behind the scenes” look at the Power Gauge…

We’ll use our one-of-a-kind system to build a list of potential opportunities in just a few seconds. And as you’ll see, six “classic bulls” meet all of our search criteria right now…

Let’s say you only want to look for stocks in a certain industry or with a dividend above 3%. The Power Gauge allows you to search for companies using either (or both) of those criteria.

What about companies with great fundamentals that the analysts haven’t upgraded yet? You can use the Power Gauge to search for companies that meet that criterion as well.

In the end, our goal with the Power Gauge is simple…

We want to make it as easy as possible for you to tailor the search criteria to your own needs. And we want to ensure that your search is always relevant for the current market.

Regular readers know all about the Power Gauge’s 20 different factors. They’re broken down into four categories – Financials, Earnings, Technicals, and Experts.

When you run a search in the Power Gauge, you can narrow your results using any of these 20 factors. You can also choose to add in specific price-return thresholds and technical indicators. And you can search within specific indexes or certain market-cap ranges as well.

As I said, the Power Gauge’s search tool is robust. And every user can customize it to their own needs.

We’ve also built some “starter” screens to make it easier to find what you want…

One of these starter screens is called “Classic Bulls.”

In short, this screen identifies “bullish” companies with intermediate-term momentum that will likely continue. So it’s useful when the market goes on a big run and starts to pull back.

In other words… exactly what it’s doing right now.

More specifically, the Classic Bulls starter screen begins with all “bullish” or better stocks in the S&P 500. From there, it narrows the search results using a pair of technical indicators…

- Stocks need to be above their rising long-term trend

- The Chaikin Money Flow indicator needs to be persistently green (“bullish” or better).

When I ran this search earlier this week, it produced 37 results. That’s a lot.

So I made a few tweaks within the Power Gauge’s search tool to drill even deeper…

First, I looked for stocks with a share price of at least $100.

These types of stocks tend to attract interest from big institutions – the so-called “smart money.” And as regular readers know, the smart money is right more often than not.

I also required “bullish” or better grades for the Financials and Technicals categories.

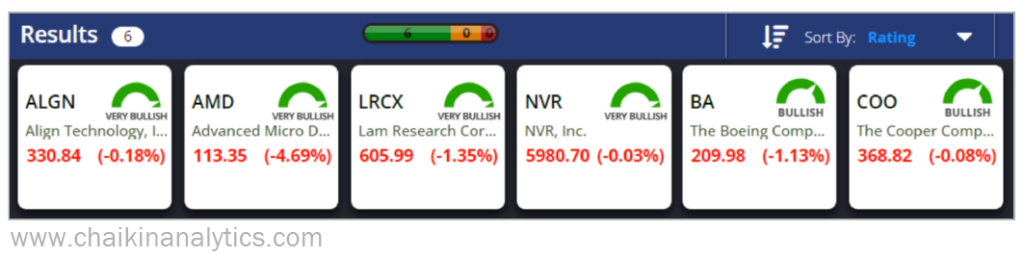

These two tweaks narrowed the search significantly. I got a much more manageable list of just six companies. And it only took a few seconds to create. Here’s the full list…

Folks, no other system in the world can do that so quickly…

The Power Gauge is our guiding light. And as I hope you’ve seen today, it can produce a manageable list of potential buying opportunities within a matter of seconds.

That’s exactly what we need when a pullback occurs.

Good investing,

Pete Carmasino

Editor’s note: If you’d like to access a short list of Pete’s favorite “buy now” stocks, you’re in luck. Until midnight tonight, he’s extending a special invitation to all PowerFeed readers. These stocks could potentially double or triple your money as today’s market shift unfolds. And it could happen quicker than anything else we publish. Get all the details right here.