Sometimes, even the world’s worst investment philosophy pays off…

I’m talking about “herd mentality.” In investing, that means buying stocks just because a lot of other folks are doing the same thing.

Herd mentality is a part of human nature…

Early nomads herded together to protect themselves from predators. These days, groups of people can offer emotional comfort and support to each other. And a herd of investors can typically get a lot more information from a company than a single person.

But the herd mentality also exposes investors to significant risks. Just think about any retail-investor-fueled mania…

If you follow the herd for too long, you’re likely to get burned.

However, as I’ll show you today, the data sometimes supports following a herd mentality – at least in the short term. And in bull markets, even the worst ideas can be “very bullish”…

I’m talking about the VanEck Social Sentiment Fund (BUZZ) today.

Given the reluctance to follow a herd mentality, many folks were skeptical when BUZZ debuted in early 2021. As its name implies, the exchange-traded fund (“ETF”) tracks social media to pick its holdings.

You see, efforts to detect mass sentiment are usually based on surveys.

But BUZZ’s model rejects surveys. According to the ETF’s creators, they suffer from a respondent’s biases, little incentive to speak truthfully, and time lags with their answers.

Instead, BUZZ monitors social media text. And it doesn’t just use keyword searches…

BUZZ applies artificial-intelligence-style “natural language processing.” The model is “trained” on conversations relating to stocks – not general consumer or social experiences.

Also, it only works with stocks that are too big to gyrate with every comment…

BUZZ scores stocks with market caps of at least $5 billion. And it requires that a stock’s daily trading volume averaged at least $1 million over the previous three months.

The ETF selects the 75 highest-scoring stocks in its model. And it refreshes each month.

They’re not weighted by market cap, either. Instead, the model weights its holdings on sentiment scores. (And no stock can start a month with more than 3% of the portfolio.)

BUZZ got crushed as the market sold off throughout last year. It plunged roughly 56% from its peak in November 2021 through its bottom on the first trading day of 2023.

That makes sense. After all, the herd mentality wasn’t about buying. It was all about selling.

But of course, it’s a much different story this year…

The bull market is back. Stocks are ripping higher. And the herd mentality is in full swing.

The Power Gauge sees what’s happening, too. It’s telling us to respect this ETF.

More specifically, it ranks BUZZ as “very bullish” today.

And when we look at the data… the herd mentality is paying off in the short term.

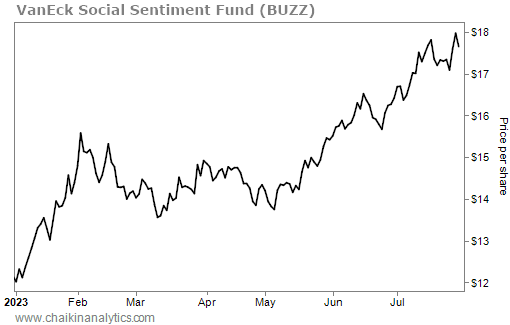

The following chart shows BUZZ’s performance since the start of the year. Take a look…

As you can see, BUZZ is up around 46% in 2023. That’s more than double the benchmark S&P 500 Index’s roughly 19% gain over that span.

So today, our takeaway is simple…

When it comes to BUZZ, the Power Gauge is currently on the same page as the herd. It’s “very bullish” on the ETF.

And in the short term, following the herd mentality has paid off for investors. BUZZ is outperforming the market. That’s true even if the ETF’s theme is cringe-inducing.

But tread lightly with this idea. You never know when the herd mentality will burn you.

Keep monitoring the Power Gauge. It will warn you when it’s time to get out.

Good investing,

Marc Gerstein