Folks, we’re in the thick of earnings season…

Investors were expecting a bloodbath. After all, many experts believe we’re on the edge of a recession.

Well, the results are starting to come in…

Roughly 235 companies in the S&P 500 Index had reported their results in this earnings cycle through Thursday. And they beat expectations by an average of 8%.

That’s definitely not the bloodbath the naysayers expected. And it gets better…

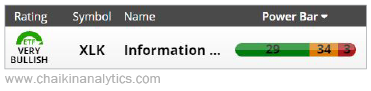

Regular readers know the Power Gauge is now “very bullish” on the technology sector. Our system first flipped to a “bullish” rating on this space in early February.

The Technology Select Sector SPDR Fund (XLK) is up more than 5% since then. And overall, it’s up around 20% so far this year.

That’s a bull market, folks.

We learned the latest earnings results from some of the most important names in tech over the past week.

So let’s take a closer look today. And more specifically, let’s see what the Power Gauge says…

We’ll start with Meta Platforms (META).

Facebook’s parent company reported its results last Wednesday. The report included its first sales increase in a year.

So not surprisingly, Meta Platforms’ share price surged at the end of last week. The stock is now up roughly 14% from its pre-earnings level.

Now, Meta Platforms has waffled between a “bullish” and “neutral” rating in the Power Gauge over the past few months. But things are looking solidly optimistic today…

The company is outperforming the broad market. And our Chaikin Money Flow indicator points to strong persistency from the so-called “smart money.” In other words, the company’s share-price activity indicates that institutional traders are buying.

So it’s no surprise that the company earns a “bullish” rating from the Power Gauge today.

Meanwhile, Alphabet (GOOGL) reported its latest results last Tuesday…

The results weren’t incredible for Google’s parent company. Growth over the previous quarter came in at a paltry 3%.

But importantly, the results beat analysts’ expectations. And beyond that, the company is cutting costs and taking the tighter advertising market seriously.

That means the company will be at its leanest – and potentially most profitable – point as the economy continues to find its footing. It’s getting in position to thrive moving forward.

Today, Alphabet earns a “very bullish” rating from the Power Gauge.

We’ll stop there. I can’t give away all of the Power Gauge ratings for the tech sector today. That wouldn’t be fair to our paying subscribers.

With that said, I can give you a glimpse into the tech sector as a whole…

I believe you’ll see from the following snapshot that the media’s current narrative around this space is disconnected from reality.

Sure, the industry is facing a wave of layoffs. And to be honest, they were likely long overdue.

But now, many of the biggest names in the tech sector have gotten more efficient. And as a result, they’re beating earnings in an admittedly tough market.

We still have a few days left of earnings season. But so far, it’s hard to see any evidence of the bloodbath the pundits called for…

In fact, only three companies in XLK earn a “bearish” or worse rating from the Power Gauge. That strong “bullish” tilt means it’s currently the top-ranked sector in our system…

Put simply, the market is full of opportunity. And the tech sector is leading the way.

But you can’t let the pundits’ invisible bloodbath cloud your vision.

Sure, some companies are still struggling. That’s just how the market works.

But today, the Power Gauge is clear. It sees a market flooded with “bullish” potential.

It’s our job to go out and find the best ways to profit.

Good investing,

Marc Chaikin