By 2010, the market was well into its recovery…

The benchmark S&P 500 Index bottomed all the way back in March 2009. It was up more than 75% by late April 2010.

And the economy was clearly moving on to its next chapter as well…

The Federal Reserve was busy holding interest rates near record lows. In turn, those actions would inflate one of the greatest asset bubbles in modern history.

It was the bull market.

And the 2008 financial crisis was in the rearview mirror… to an extent.

Folks, this is the important part…

Even with the market up more than 75% and a recovering economy, many people still feared the worst. Then, a roughly 16% correction through July 2010 sent the media into a frenzy.

At that point, the term “double-dip recession” returned to the front of everyone’s minds…

Please keep that point in mind when I show you the most “bullish” sector in the Power Gauge right now. Put simply, this sector scares people – and with good reason, too…

The sector was the poster child for the market’s wipeout in 2022. And even today, we’re still hearing about layoffs from many of its largest companies.

But as I’ll explain, those fears are overblown once again…

If you haven’t guessed already, I’m talking about the technology sector.

Seriously.

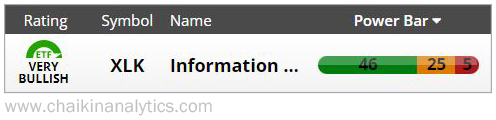

Technology is the most “bullish” sector in terms of the Power Bar ratio today. Take a look…

Specifically, this is the Power Bar ratio for the Technology Select Sector SPDR Fund (XLK). Regular readers know this exchange-traded fund (“ETF”) is one of our broad measures for tech stocks.

At a glance, the Power Bar ratio shows the Power Gauge ratings of all the stocks in the ETF. And as you can see, most of the stocks are “bullish” or better today – 46 to be exact. Meanwhile, only five of XLK’s holdings currently earn “bearish” or worse rankings.

That Power Bar setup puts XLK in the No. 1 spot among all 11 top-level market sectors. But if you’re like many investors, you probably don’t want to hear me say that today…

After all, the tech sector was the focal point of a lot of recent investing pain.

Folks who bought shares of XLK near the December 2021 top and panicked out near the October 2022 bottom lost as much as 34%. And that was just the sector ETF. Many investors were overweight in the riskiest tech-related positions – and suffered worse…

Massive tech-related companies like electric-car maker Tesla (TSLA) and Facebook owner Meta Platforms (META) lost more than 60% in 2022. And now, despite six months of upward momentum in tech stocks, many investors are still looking for the next “double dip.”

This is a classic investing error…

Many investors worry about what hurt them the last time – no matter how unlikely it is. And more often than not, these fears keep them on the sidelines as the next boom unfolds.

Will it be smooth sailing for tech stocks from here? Of course not…

Corrections are normal. And volatility happens as the market shakes off a crisis.

But regular readers know we’ve seen “bullish” signs in the market for months. And now, the Power Gauge is telling us the tech sector in particular is flush with opportunity…

Will you use it to help you find that opportunity? Or is the fear of the double dip keeping you on the sidelines?

Don’t make this classic investing error today.

Good investing,

Marc Chaikin