George Orwell’s dystopian novel 1984 is one of the most popular books of all time…

It’s set in a place called Oceania. And the dictator-like leader “Big Brother” runs everything.

Many people focus on that point when they talk about the book these days. With cameras on seemingly every corner, they argue that the government watches every move we make.

But I bet you didn’t realize Orwell’s classic also contains a valuable investment lesson…

You see, Oceania is always at war. Sometimes, it battles Eurasia. Other times, it fights Eastasia.

Importantly, though, Oceania has a strict “no change” policy. It doesn’t allow for changing facts – like who the country is fighting on a particular day. Here’s what Orwell wrote…

No change in doctrine or in political alignment can ever be admitted. For to change one’s mind, or even one’s policy, is a confession of weakness. If, for example, Eurasia or Eastasia (whichever it may be) is the enemy today, then that country must always have been the enemy. And if the facts say otherwise then the facts must be altered. Thus history is continuously rewritten.

Imagine if the facts couldn’t change in the markets…

Investors who follow Big Brother’s no-change doctrine would either be “bearish” or “bullish” on a stock from the beginning. And they would stay that way until the end of time.

But as we’ll discuss today, the facts can change. As investors, we need to accept that…

Fortunately, we have the Power Gauge on our side.

And unlike Big Brother, our one-of-a-kind system doesn’t need to rewrite history to avoid changing facts. Over time, it switches between “bearish,” “neutral,” and “bullish” grades.

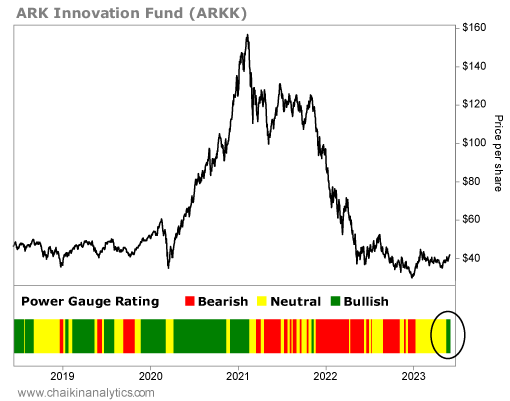

Cathie Wood’s ARK Innovation Fund (ARKK) is the perfect example. Based on the facts, investors were correct to follow the Power Gauge’s shift to “neutral” and then to “bearish” starting in early 2021…

ARKK’s price fell about 74% from the system’s initial downgrade to “neutral” on February 19, 2021 through May 18 of this year. That was much worse than the Technology Select Sector SPDR Fund’s (XLK), which gained roughly 16% over the same span.

But it’s a different story with tech stocks these days…

After getting crushed for a long time, this sector is surging once again. XLK is up around 35% in 2023. And Wood’s tech-heavy exchange-traded fund (“ETF”) is up about 33%.

The Power Gauge is now “bullish” or better on nine of ARKK’s holdings. It’s only “bearish” or worse on four holdings. And on May 19, it turned “bullish” on the ETF. Take a look…

Now, contrary to what Big Brother believes, the Power Gauge isn’t admitting weakness. It’s simply recognizing updated data about Wood’s flagship ETF – in other words, new facts.

And so far, the Power Gauge has proven to be good at tracking ARKK’s moves…

Our system first ranked the ETF in May 2015. Since then, ARKK’s annualized average return on days when it’s “bullish” or better is 32%. On “neutral” days, it’s 15%. And on “bearish” or worse days, it’s a 4% loss.

In Orwell’s classic novel, Big Brother needed to project strength. But we’re not living in that dystopian universe…

We’re living in the real world.

So we can acknowledge ARKK’s bad times in the past. And now, with the Power Gauge as our guide and tech stocks soaring in recent months, we can see the “bullish” setup.

Now, that doesn’t mean we have to rush out and buy ARKK shares today.

As I’ve said before, Wood strikes me more as a futurist than an investor. That can be spectacular if things break her way. But it would be disastrous for investors like us if they don’t.

In the end, the Power Gauge looks at all the facts. Wood’s tech-heavy ETF is thriving right now. But that won’t always be the case.

So our takeaway is simple…

When the facts change, it’s OK to change our mind.

Good investing,

Marc Gerstein