If all publicity is good publicity, Cathie Wood is riding high…

Wood is the founder and CEO of ARK Investment Management and its future-themed exchange-traded funds (“ETFs”). She has always been polarizing. Her bold “calls” about the market often make headlines in media outlets like CNBC and the Wall Street Journal.

But since February 2021, Wood’s ETFs have fallen hard. And the publicity has been much rougher…

In fact, Dan Ferris – a longtime editor at our corporate affiliate Stansberry Research – was especially harsh just last week on Wood’s latest venture (and justifiably, I believe). Wood now wants to bring small investors into the high-risk world of futuristic private equity.

Before I go any further, let me make one thing clear…

I’m not here to defend Wood as an investor. And neither is the Power Gauge… Six of the seven ARK ETFs rated within our system are “bearish” or “very bearish” today.

The “best” of the bunch is the ARK Genomic Revolution Fund (ARKG). It has plummeted in line with Wood’s other ETFs. But at least for now, the Power Gauge rates it as “neutral.”

However, her ETFs’ poor performance aside, I do want to discuss Wood as a futurist today. And importantly, we’ll consider better ways for us to pursue that investing theme…

Throughout history, futurists have shown a remarkable tendency to get things right.

Early proponents of railroads correctly predicted that it would change transportation and the way we shipped goods. And of course, more than a century ago, Henry Ford and other futurists anticipated the benefits of mass production.

Futurists in the 1980s who thought semiconductors would change the world also fit into this category. And the early advocates of digitization, the “information superhighway,” and e-commerce all proved to be correct as well.

To that point… I believe Wood’s visions are spot on.

Like many others, Wood speaks about “disruptive innovation.” But unlike others, she articulates her vision more eloquently. She defines innovative technologies as those that…

- Experience dramatic cost declines and unleash waves of incremental demand,

- Cut across sectors and geographies, and

- Serve as a platform for additional innovations

Wood has identified five “major innovation platforms” that meet these criteria. They are artificial intelligence, energy storage, robotics, DNA sequencing, and blockchain technology.

If you hunt around, you can find many individual companies in each of these areas. And even better, the Power Gauge favorably ranks a bunch of them right now.

We can think of the Power Gauge as a bridge that connects futurism to sensible investing…

Future-themed companies often show bad numbers today – especially relating to valuation. But importantly, with these companies, we expect better results in the future.

So yes, these companies might fare poorly in some of the Power Gauge’s fundamentals-focused factors (like the Financials and Earnings categories).

But remember, that’s why the Power Gauge analyzes 20 different factors. It helps us see the entire picture about more than 5,000 companies and ETFs in its universe.

You see, the system isn’t just about what’s happening today. It also has plenty of factors in the Technicals and Experts categories that reflect future expectations.

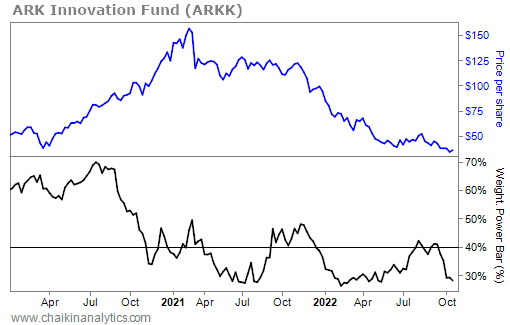

And to put it simply, ARK Investment Management’s ETFs have suffered from their failure to use the Power Gauge as the bridge that connects futurism to sensible investing…

For example, the flagship ARK Innovation Fund (ARKK) only owns four stocks with “bullish” or better Power Gauge rankings today. And it owns 14 stocks with “bearish” or worse rankings.

Using that data, we can figure out that ARKK’s “Power Bar” ratio is 22%. (That’s four “bullish” or better stocks divided by 18 – all the stocks ranked favorably or unfavorably in this ETF.)

For this Power Bar ratio, we consider anything below 40% to be a “bearish” characteristic.

Importantly, this isn’t just the current view from the bottom. ARKK’s Power Bar ratio has been routinely “bearish” in terms of this metric for a long time. Take a look…

But the thing is… future-themed investments don’t need to score so poorly.

For example, the Power Bar ratio for the Technology Select Sector SPDR Fund (XLK) currently equals 61%. The First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID) comes in at 62% today.

And the Loncar Cancer Immunotherapy Fund (CNCR) is at an impressive 88%.

By now, I hope you get the picture…

It’s important to read and think about Wood’s futuristic vision. Based on history, she’s likely right about a lot of things.

But when it comes to parting with your money, be much pickier. Don’t settle for Wood’s ETFs. Instead, use the Power Gauge to look for future-themed options with better setups.

Feel free to dream. Just open your eyes before you open your wallet.

Good investing,

Marc Gerstein