Cathie Wood is at it again…

Bloomberg interviewed the ARK Investment Management founder and CEO last Friday. And during the conversation, she declared… “We are the new Nasdaq.”

It’s a bold statement. It implies that the industry’s most trusted tech-tracking index is dead.

And the thing is… Cathie Wood is on to something.

Simply put, Nasdaq 100 Index mainstays like Apple (AAPL) and Alphabet (GOOGL) led the way in growth and innovation for a long time. But now, they’re no longer growth monsters.

Meanwhile, Wood’s flagship ARK Innovation Fund (ARKK) represents the next generation of tech innovation. It includes companies like Tesla (TSLA), Spotify Technology (SPOT), Block (SQ), and Zoom Video Communications (ZM).

And like them or not, these businesses now offer more growth potential than the old guard.

But as I’ll explain, that still doesn’t mean ARKK is the answer for investors today…

In addition to Apple and Alphabet, the Nasdaq 100 also includes companies like Microsoft (MSFT), Amazon (AMZN), and Cisco Systems (CSCO). They’re all established tech leaders.

As a result, the Nasdaq 100 has been the industry benchmark for nearly 40 years.

But the tech industry is evolving…

Next-generation companies like Tesla, Spotify, Block, and Zoom are now making their marks. And they’re changing the investment landscape…

The old guard simply doesn’t have the same juice anymore. Think about it…

Do you think Apple will sell twice as many iPhones next year? Or do you think people will make twice as many Google searches next year?

Innovative tech investors want growth. And folks can’t rely on the Nasdaq 100 leaders to do that anymore.

That’s why many investors are getting behind Wood. They’re looking for a new industrywide gauge for tech stocks…

ARKK is a top contender – and perhaps justifiably.

As I’ve said before, the exchange-traded fund (“ETF”) is looking to the future. It focuses on “disruptive innovation” in areas like digital payments, video communication, electric vehicles (“EVs”), streaming services, and cloud computing.

Just look at ARKK’s top holding, Tesla…

The electric-car maker accounts for about 10% of the ETF. (Tesla is also a top company in the Nasdaq 100.)

Tesla is the global leader in EVs. It brought them to the market before mainstream companies like Ford Motor (F) and General Motors (GM) even considered the idea.

So then, it comes down to how much growth investors expect from here…

Will Tesla still dominate the EV space in 2040? And how long will it take for the overall EV market to achieve its full potential?

We can’t yet answer those questions. But right now, Wood is right in at least one way…

It’s clear that ARKK now provides more exposure to disruptive-innovation stocks than the Nasdaq 100. And collectively, these companies have a lot more growth potential.

But that doesn’t mean we should rush out and buy ARKK shares…

Sure, ARKK can soar in a raging bull market. However, as we’ve seen over the past two years, it craters when times get tough. It’s a lot more volatile than many folks can stomach.

In other words, it’s important to get the timing right.

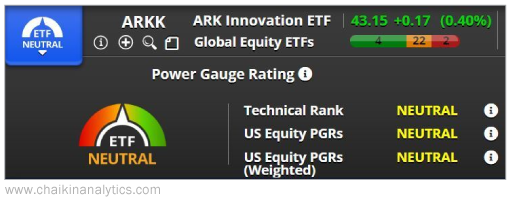

Currently, the Power Gauge ranks ARKK as “neutral” across the board. Take a look…

ARKK experienced a huge wipeout. And we’re still waiting to see what its next leg looks like.

So in the end, our takeaway is simple…

The Nasdaq 100 isn’t what it used to be. And the market is still searching for its next tech benchmark.

Cathie Wood wants us to believe it’s ARKK. And the ETF does offer potential in the years ahead.

But for now, the Power Gauge isn’t convinced. It’s still flashing “neutral.”

So we’ll follow its lead and remain cautious for the time being.

Good investing,

Marc Gerstein