“They’re out of stock in my size.”

We’ve all been there. Buying clothes can be a pain.

So on its face, solving that problem seems like an admirable goal. It’s exactly what retailer Old Navy set out to do last summer…

In short, the company’s top brass embraced “inclusive” sizing. Executives announced a plan to stock every size – from extra small all the way to 4XL – in every store.

Now, your first reaction might be something like, “That’s nice. Everyone should be able to buy clothing that fits them.” And you wouldn’t be alone…

One shopper from Texas said, “Old Navy made me feel included and worthy of having clothes that look nice even though I’m a larger person.”

Hearing that feels great! But there’s a problem…

You see, retail doesn’t involve infinite resources. Each store has limited space. And the inventory budget is limited as well.

So in pursuit of inclusiveness, Old Navy’s stores cut down on their “middle sizes” inventory.

Shoppers noticed. And the decision cut into the company’s sales… Old Navy simply didn’t have enough stock in stores in the sizes that its customers wanted the most.

Folks, the CEO and the leadership team at Old Navy – and its parent company, The Gap (GPS) – were chasing “tails.” Not cat and dog tails, of course. I’m talking about statistical tails.

In this case, Old Navy got a lot of “feel good” press in the beginning. But over time, it turns into a fatal business error if you’re running a “mass market” operation…

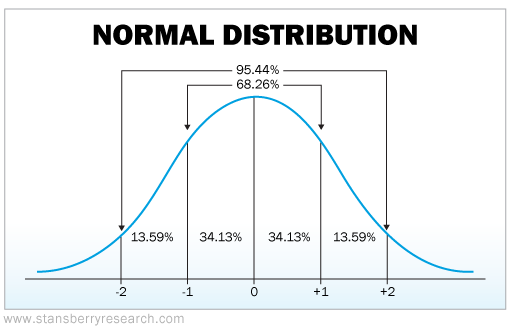

Almost every type of population fits inside a “bell curve.” You might’ve seen it described visually like this before…

Don’t worry, I’m not sending you back to math class. We just need to understand one simple part…

In a bell curve, about 68% of a population fits in the middle. And as I said, most populations fit under a distribution chart that looks very similar to this one.

That includes the distribution of people’s weight…

Beyond the middle section, you’re looking out toward the “tails.” In other words… if you target those smaller chunks of the graph, you’re focusing on fewer customers.

That’s exactly what happened to Old Navy…

Old Navy made a feel-good statement. It tried to solve a problem with an admirable solution. But that move came with a business decision to chase the tails of the distribution.

It was a huge error…

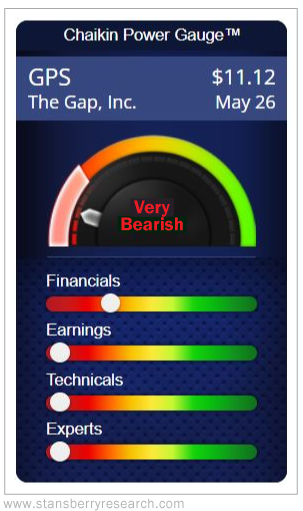

The Gap lost $162 million last quarter. In comparison, the company made a $166 million profit during the same period in 2021.

Not surprisingly, investors are mad. The Gap’s stock is down roughly 70% over the past year. That’s a staggering loss.

And today, the company earns a “very bearish” rating from the Power Gauge…

Folks, Old Navy faced a perfect storm. And by extension, its parent company did as well. Company executives were chasing feel-good stories and statistical tails.

It might’ve looked like a great strategy when the economy was soaring. But once trouble started brewing, it proved to be a risky misstep.

Remember this lesson for your own investments…

The CEOs of mass market companies like Old Navy or The Gap need to focus on the middle of their populations. If they start making tail-chasing promises… beware.

That’s like saying, “I want to sell less to our customers.”

And of course, that’s never a good thing.

Good investing,

Carlton Neel