If you’re a fan of TV classics, you’ll likely recognize Milburn Drysdale’s name…

Actor and comedian Raymond Bailey played Drysdale in the 1960s show The Beverly Hillbillies. Specifically, he was the head of the fictional Commerce Bank of Beverly Hills.

Drysdale lived next door to Jed Clampett, an accidental oil millionaire fresh from the Ozarks. Clampett and his family also happened to be Drysdale’s biggest depositors.

As the protector of the Clampett clan’s fortune, Drysdale was under a lot of stress…

You see, Jed Clampett always asked to visit the bank’s vault to see his money. He wanted to make sure all $96 million was safe and sound.

But the thing is… the money wasn’t in the bank’s vault.

Like all bankers, Drysdale was lending the Clampetts’ money out to others. So over the course of the series, he had to keep making excuses about why Jed Clampett couldn’t visit.

If Clampett had realized the money wasn’t there, he likely would’ve gotten his shotgun.

Now, I realize I’m talking about a TV show. The Commerce Bank of Beverly Hills didn’t exist.

But this example does show the relationship between real-life banks and a lot of folks…

Jed Clampett didn’t know how the banking sector really worked. And throughout history, millions of people across the U.S. have been in similar situations with their money.

But now, we’re living in a different era…

Everyday Americans are now smarter with their money. That’s making it harder for bankers like Milburn Drysdale to “make money with other people’s money” like in the old days…

Banking is a complicated business. It involves all sorts of intricacies like regulation, loan growth, asset portfolios, maturity-matching approaches, reserves, fee income, and mergers.

But at its core, this industry is about one thing…

Banks want to maximize the difference between the money they bring in through the interest they get from borrowers and the money they send out in interest to depositors.

Rising interest rates used to be good for banks. Their lending rates rise along with the Federal Reserve’s benchmark interest rate. That means more money coming in the door.

And banks stayed as stingy as possible for as long as they could about sending out money.

The challenge is stretching the gap as wide as they can. That’s the “margin” for banks.

Jed Clampett never understood the gap. And for generations, real-life consumers didn’t care much about it. But the story is a lot different with computers at our fingertips nowadays…

In short, depositors are using all sorts of data to force the banks to pay more interest.

Back in March, I pointed out how free web portals like NerdWallet (NRDS) and Bankrate make it easy for regular people to “comparison shop” for banks. And folks can quickly move their money to the banks that pay higher interest rates for deposits.

Commercial and institutional depositors are also thinking about interest…

In the second quarter, JPMorgan Chase (JPM) said it lost about 10% of deposits from these types of customers over the previous year. At Bank of America (BAC), corporate customers are keeping 60% of their cash in interest-bearing accounts. That’s up from 30% in 2022.

The point is simple…

Today’s savvier depositors are less tolerant of windfall bank margins. When the Fed raises rates, they expect to share the wealth a lot more than they ever have before.

This trend isn’t reversing…

Banks will need to adapt to smarter customers and tighter margins. That won’t happen overnight. And the path will likely be full of volatility.

In fact, the Power Gauge tells us it’s wise to be cautious in this space right now…

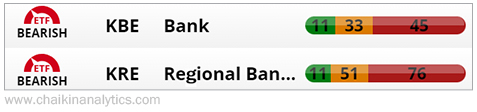

Here are the current Power Bar ratios for the SPDR S&P Bank Fund (KBE) and the SPDR S&P Regional Banking Fund (KRE). As you can see, they’re overwhelmingly “bearish”…

In the end, I hope my takeaway is clear…

Rising rates on their own are no longer a signal to buy bank stocks. It’s becoming tougher for these institutions to make money with other people’s money as they did in the past.

And the Power Gauge helps us see the situation clearly…

Now isn’t the time to invest in bank stocks. Instead, watch closely from the sidelines.

Good investing,

Marc Gerstein