Maybe you think of Adobe (ADBE) as the PDF-reader company…

Or maybe you remember the company’s once-ubiquitous Adobe Flash web tools.

But you might not know that Adobe is now a subscription-revenue powerhouse…

In 2021, 73% of Adobe’s revenue came from its “digital media” segment. And that segment mostly focuses on the company’s Creative Cloud offerings.

You likely haven’t heard of the Creative Cloud. But almost every content-creation professional interacts with it. And every month, like it or not, they pay for that service.

From a business standpoint, this recurring revenue makes Adobe a fundamentally good company. And for the most part, the Power Gauge agrees with that idea.

But that doesn’t mean you want to own Adobe’s stock right now…

It’s down roughly 58% from its November 2021 high. It’s a poster child in the bear market’s tech wreck. And now, Wall Street analysts are finally getting around to downgrading it.

Today, let’s explore what the Power Gauge saw and Wall Street missed…

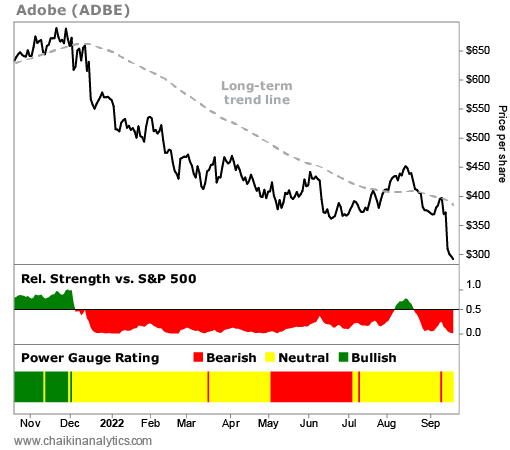

The Power Gauge rates Adobe as “neutral+” right now. That basically tells us the company looks good overall. But importantly, its stock trades below its long-term trend line.

In fact, Adobe’s stock recently plunged almost 17% in a single day. It’s hitting a new 52-week low almost daily. And it’s now trading around its COVID-19 pandemic low.

Adobe’s stock has tumbled from a high of about $688 per share in November 2021 to roughly $286 per share today. As I said, that’s a staggering 58% decline in less than a year.

Now, it’s no secret that markets fluctuate. But for a stock to fall that far in a relatively short period… you might think something is seriously wrong with the company.

That doesn’t seem to be the case with Adobe, though. The recurring revenue from its Creative Cloud is a great quality. It’s a telltale sign of a fundamentally strong business.

And earlier this month, Adobe announced plans to buy design platform Figma…

To me, that seems like a good idea. Adobe is taking advantage of the tough environment to expand its offerings. It’s a $20 billion buyout – half in cash and half in stock.

For Adobe, that isn’t much money. The company’s market cap is roughly $134 billion.

However, Wall Street wasn’t thrilled. And investment banks downgraded the stock in response.

But the problem is… the stock’s downtrend started months before this announcement.

Where were all the Wall Street analysts when Adobe’s sell-off began last November?

Let’s take a look at Adobe’s price chart…

I want to draw your attention to two things…

First, notice the Power Gauge rating in the bottom panel. Adobe’s stock fell below its long-term trend line in November – which pushed its rating to “neutral+” at the time.

But that wasn’t a signal to sell. It just meant to be careful.

That brings me to the second thing…

Look at the relative strength panel in the chart. Notice the breakdown in early December, when Adobe traded at roughly $650 per share. That was the signal to sell the stock.

And it leads me back to the Wall Street analysts…

Why did they wait until the stock fell to about $300 per share before downgrading it? Is Adobe’s deal to buy Figma really the catalyst they needed to act?

I’m not sure exactly. But frankly, it doesn’t matter. My point is simple…

If you have the right tools, like the Power Gauge, you don’t need to rely on Wall Street. You can make your own decisions – and you’ll likely save yourself a lot of money in the process.

Good investing,

Pete Carmasino

Editor’s note: It’s more important than ever to have the right tools. The broad market is down roughly 21% this year. And many stocks – like Adobe – have fallen much further.

In short… if you’re like most folks, you’re likely looking for a “financial lifeline” right now.

That’s why Chaikin Analytics founder Marc Chaikin is teaming up with our corporate affiliate Altimetry’s Joel Litman to host a FREE online event. No matter what happens with the overall market, they believe one approach could help you “5x” your money from here.

The event is set to begin promptly at 8 p.m. Eastern time TONIGHT. Sign up right here.