I think my AI app is brain-dead…

Lots of folks have been playing with the latest artificial-intelligence tools lately. One of my colleagues was thrilled to show me the decent answers he was getting from AI.

So I asked his app about our Power Gauge. And things didn’t go well.

This should have been easy. Marc Chaikin has had information about the Power Gauge online for more than a decade now. And I was using an app with a rock-solid rating… 4.8 out of 5 stars from more than 41,000 users.

This AI started with blandly accurate facts. I’ll spare you the details… Suffice it to say, it felt like a psychic telling me I have dead relatives.

Eventually, something suspicious caught my eye. So, I pounced. I asked if the Power Gauge considers dividend yield.

The app said yes… and that this model “evaluates the sustainability of a company’s dividend payments.” It also discussed how the Power Gauge “accounts for potential changes to the dividend yield.”

That would be impressive, except for one thing…

Our model doesn’t consider dividend yield.

And when I asked the app to list the 20 Power Gauge factors, it made 12 different errors.

If you haven’t had this experience yet… it’s eye-opening. Unlike the crystal ball that its fans see, this AI app was more like your elderly uncle confidently passing along information that he doesn’t actually understand.

Now, that doesn’t mean we can’t admire AI or invest in it. But we need to be critical thinkers.

Personally, while I might trust AI to handle a hamburger order, I wouldn’t rely on it to answer life’s questions…

Wendy’s (WEN) is taking the right approach.

It wants to use Google Cloud’s AI software to take drive-thru orders. It hopes this approach will speed up the lines, boost accuracy, and solve its difficulties in finding human labor. The company is starting with one test store near its headquarters.

In this robot-run Wendy’s, one human employee will make sure the AI is getting things right. For example, AI has to know that if the customer asks for a “large milkshake,” it should translate that to Wendy’s-speak – a “large Frosty.” The employee will also jump in if a customer demands to talk to a human.

Wendy’s is managing expectations about this pilot program. It doesn’t expect perfection.

In 2022, this system got orders right only 79% of the time. Wendy’s aims to match its rivals’ 85%-plus accuracy rates.

Notice how different all this is from so much of today’s AI hype.

Wendy’s isn’t looking for “golly gee whiz” reactions. It’s not after linguistic, auditory, or visual stunts. It seeks commercial usefulness… and sets a low bar.

Compare the Wendy’s strategy with the AI-hype darlings… Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT).

Now, you’ll see that these companies score well in our Power Gauge rankings. But for them, AI is minuscule at best… and they’re in the “golly gee whiz” side of the field. They’ll retain or lose their Power Gauge stature based largely on things unrelated to AI.

Their rank-and-file employees know this… And many are leaving to work at or fund AI startups.

If you’re interested in the AI trend, follow their lead…

These startups are the companies that will turn AI from a “golly gee whiz” toy into something real and vital. And they’ll make an incredible profit from it.

It goes beyond replacing fast-food workers… AI will assume a role in lucrative fields like programming, chipmaking, and, to some extent, industrial automation.

This lacks the warm-and-fuzzy feeling of AI-generated poetry or art, like you’ll see in the headlines. But machines that think and communicate are already in widespread use. This trend will continue.

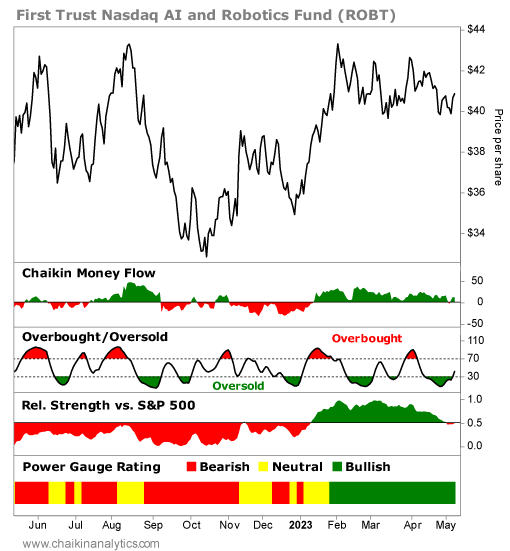

The Power Gauge is “bullish” on the First Trust Nasdaq Artificial Intelligence and Robotics Fund (ROBT).

Its 108-stock portfolio is broadly diversified among AI enablers.

ROBT’s peer, the Global X Robotics & Artificial Intelligence Fund (BOTZ), also ranks “bullish.” Still, ROBT is a more diversified fund… BOTZ has only 45 positions, and its top 10 stakes hog 65% of portfolio assets. Nvidia (NVDA) alone consumes 9.5%.

Regardless, remember the realities of what we’re dealing with today. AI is the most hyped topic investors have confronted since the bitcoin peak.

But as of right now, it’s not magic. And while folks enjoy toying with AI apps like the one that botched our Power Gauge factors, there isn’t a clear business case for them. When you’re choosing an AI investment, you want the companies in the ROBT fund – not the brain-dead apps that your friends idly play with.

And personally, I’d rather eat an AI hamburger than trust AI to answer all of life’s questions.

Good investing,

Marc Gerstein