Roman Emperor Nero needed to fix his image…

You see, many folks in his day assumed he started the Great Fire of Rome roughly 1,960 years ago.

Some Roman citizens suggested he wanted to create a realistic backdrop for a play about the burning of Troy. Others accused him of wanting to clear land for a new palace.

But the thing is…

Nero reportedly wasn’t even in Rome when the fire started. He rushed back and organized a major relief effort.

Later, Nero blamed and executed Roman Christians for starting the fire. But truthfully, we may never know what really caused the fire that destroyed two-thirds of the city.

Roman builders thought differently…

They believed wood construction was the main culprit. So they started turning to brick.

Of course, wooden buildings never completely vanished from history…

Many single-family homes are made out of wood and related materials these days. And as I’ll show you today, a “wooden renaissance” is underway with bigger buildings as well.

That’s great news for one favorably ranked company in the Power Gauge. As you’ll see, this “bullish” stock provides us with another side of the surging homebuilders industry…

In short, the company we’re talking about today is a real estate investment trust (“REIT”). But it’s a different kind of REIT…

You see, most REITs make their livings as landlords. They collect rent from their tenants. And they historically served as good income investments…

Tax rules require REITs to distribute earnings as dividends. So in the past, they often came with good yields.

The COVID-19 pandemic ruined that. Pandemic-related restrictions drove rent collections down toward zero.

And the post-pandemic recovery has been uneven. Shopping malls and office buildings may not fully recover for a long time.

But as I said, PotlatchDeltic (PCH) is a different kind of REIT…

Rather than for-rent buildings, it owns timberlands and sawmills. So the company sells logs and lumber to make money.

And PotlatchDeltic has an important extra kicker today, too…

Unlike back in Roman Emperor Nero’s time, wood can actually provide fire safety.

Builders can glue multiple thick layers of wood together. In a fire, outer surfaces will char. But inner layers will hold strong. And they’ll outlast the time steel takes to reach its melting point.

Wood isn’t strong enough to support huge skyscrapers. But it has a much lower carbon footprint than concrete or steel. That’s why it’s a big part of a wooden renaissance…

In short, we’re increasingly using it for all kinds of mid-rise buildings.

For example, Milwaukee’s 25-story Ascent tower uses concrete for the base, elevators, and stair shafts. But the rest of the structure uses engineered wood products.

And obviously, single-family housing demand is important to PotlatchDeltic…

Massive new construction will occur to make up for the shortage in affordable housing. It’s not a question of “if.” It’s only about “when.” And anything that improves affordability – lower mortgage rates or lower sticker prices – will get things going.

That’s why homebuilding remains one of the strongest Power Gauge industries…

The SPDR S&P Homebuilders Fund (XHB) is “very bullish” today. Plus, its Power Bar is strong as well. The exchange-traded fund (“ETF”) has 25 “bullish” or better holdings. And none of its 34 total ranked holdings are “bearish” or worse.

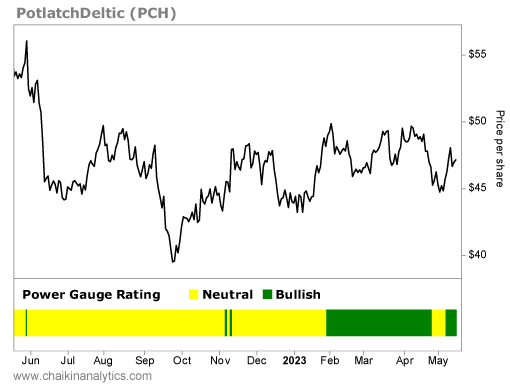

So it makes sense that PotlatchDeltic also ranks “bullish” today. After all, it serves all the homebuilders with its wood products. Take a look…

PotlatchDeltic is appealing to investors for another reason as well…

It’s a solid income play.

The stock’s current $0.45-per-quarter dividend implies a 3.9% yield. And a special dividend paid at the end of last year pushes its yield up to 5.8% over the trailing 12 months.

Going forward, we expect the wooden renaissance to keep propelling the housing industry…

The Power Gauge is all over this situation. It’s “very bullish” on one of the main homebuilder-filled ETFs. And it’s “bullish” on another side of the industry with PotlatchDeltic, too.

So if you’re not paying attention yet… I recommend taking a closer look today.

Good investing,

Marc Gerstein