Last Thursday, I discussed what could be the start of a new trend in the markets… and why it could be the beginning of a “riptide.”

Put simply, the tech-heavy Nasdaq 100 Index is breaking down versus the broad market S&P 500 Index.

As I explained, we can see that through the recent weak relative strength of the Invesco QQQ Trust (QQQ) versus the SPDR S&P 500 Fund (SPY).

But it’s more than just a bit of underperformance in tech…

I’m also seeing current trends play out in some specific sectors.

Markets are heavily rotating in these areas. This tells a story of where the “smart money” is flowing.

Now, some folks might view this as a “broadening out” of sectors – meaning that the lagging, “old industrial” type sectors are just catching up to the hot tech stocks. And that may be true.

But no matter the outcome, these look like early signs of something else.

You see, investors are turning to “hard” assets. And these are the sectors that institutions turn to when they prepare for a specific type of storm…

I’m talking about stagflation.

This is an environment that contains high inflation, slow economic growth, and high unemployment rates.

You should view this as a technical definition – meaning that when all three occur, we have stagflation.

Right now, we have one of the three: just high or persistent inflation.

While inflation is down from the peak in June 2022, it has still proved to be stubbornly “sticky” in recent months. And it has still been above the Federal Reserve’s target of 2%.

Meanwhile, slow economic growth and high unemployment aren’t showing up in the data (at least not yet).

And this could explain why a rotation into these sectors is occurring early.

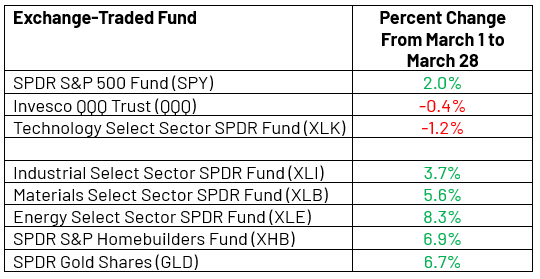

Take a look at what happened with various exchange-traded funds (“ETFs”) in March…

Now, the recent performance isn’t a long-term sample size. It’s looking at the previous month of data, but the performance is undeniable…

We’ve seen the sectors that institutions go to in preparation for stagflation outperform the S&P 500 and the tech-heavy funds.

This is a small sample, but it reflects previous periods when stagflation was in the economy – mainly the 1970s.

It was a tough investing period back then. Precious metals like gold and silver did well. And so did commodities – oil in particular.

The Federal Reserve did the same thing back then as it did recently: aggressively raising interest rates to fight inflation.

Now, with rates higher for longer, we may see some economic damage. Higher unemployment leads to slow economic growth. When that happens, more “defensive” sectors outperform.

And I would think that when unemployment starts to rise, that’s when the Fed will lower rates – not before it rises.

So, putting it all together…

I’m not throwing in the “investing” towel right now. We may not see a slowdown for quite some time. So this isn’t a reason to dump stocks and run for the hills.

But I’m acknowledging the “riptide warning.” Rather than fight the riptide – the trend in the market – it may be a reason to “float” and let the trend take us to areas that are safer.

I’ll be closely paying attention to what happens with these trends moving forward – and if they develop into something bigger.

Good investing,

Pete Carmasino