I know from firsthand experience that riptides are powerful…

As a surfer in my teens, I was carried more than 45 blocks along the New Jersey shoreline while surfing in pre-hurricane conditions before I could get out of the water.

What saved me? I didn’t fight the tide. I floated on my board along the shoreline and waited it out.

Thankfully, I learned that as a youngster. I was a great swimmer, but no one person is greater than the tides of the ocean.

Lifeguards have a saying along the lines of “riptides don’t drown people, people drown in riptides.” The undertow is the main thing that makes people panic and start to exhaust themselves swimming.

Overestimating your swimming ability and underestimating the riptide is a recipe for disaster.

The same is true in the markets. What may look like a broadening out of performance can turn into a new trend – a tide – which takes you out to “sea” if you aren’t in the right stocks. It’s like a “riptide warning.”

Thankfully, we have an investing guide here at Chaikin Analytics to help us…

You see, our Power Gauge system doesn’t just track fundamentals. It also gives us technical indicators.

And the one I tend to rely on the most is relative strength.

It shows me if a stock or exchange-traded fund (“ETF”) is beating the S&P 500 Index. And to track the S&P 500, we use the SPDR S&P 500 Fund (SPY) .

Now, here’s the most important thing to remember…

If a stock or fund isn’t doing well when SPY is also underperforming, there’s a big problem. Not only is that stock or fund going down, it’s also down more than the broad market.

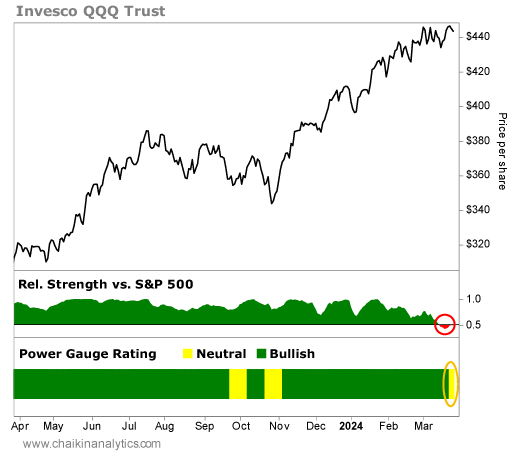

This leads me to the recent performance of the Invesco QQQ Trust (QQQ). It’s an ETF we can use to track the tech-heavy Nasdaq 100 Index.

Now, I’m not saying that alarms are sounding to “get out of the water” with tech. But right now, I see the makings of a move lower. Take a look at the chart below…

You can see in the red circle that QQQ’s relative strength versus the S&P 500 has just turned lower. That’s after months of stronger relative strength versus the broad market.

And in the yellow circle, you can see the Power Gauge has just changed from “bullish” to “neutral” on QQQ. That’s also after months of a “bullish” rating.

Now, this alone isn’t enough to change our overall bullish outlook…

We can see the broader indexes like the S&P 500 and the Russell 3000 are still doing well. And since QQQ is heavily weighted in the large-cap tech stocks, it is weakening. Its top-heavy nature speaks to both its incredible performance in the past year and to the recent move down.

And now, with inflation and interest rates driving market sentiment, technology could be taking a well-deserved breather.

In my next essay on Monday, I’ll review the sectors that are now broadening out versus QQQ and the S&P 500 – and what that means for us as investors.

Good investing,

Pete Carmasino