I don’t relive my glory days in sports often, mainly because they’re only exciting to me…

As a kid, I excelled in multiple sports. And I played football in high school and college. As I got to those levels, the competition was fierce. So it helped to have special skills…

I was fast. And I could also jump really high for my height. At age 15, I was only about 5 feet, 7 inches tall. But I could grab the rim of a 10-foot, regulation-sized basketball hoop.

In my personal “playbook” for sports, I learned that I could disrupt the other team with my speed and jumping ability. It didn’t matter whether I was on offense or defense.

My glory days eventually ended. But when I entered the financial industry, I realized that finding long-term success in the market is a lot like building a playbook in sports.

The competition is just as fierce in the markets as it is in sports.

Speed matters. And so does the ability to jump from “risk on” to “risk off” assets.

Here’s what I mean…

First, let’s define the terms…

“Risk on” is about being invested in growth stocks. These types of stocks inherently come with higher risk…

You’re betting on future growth. It’s not guaranteed to happen. But investors hope these riskier bets pay off. And they often do. That’s when it pays to have a risk-on approach.

When it comes to Wall Street’s playbook, a risk-on approach is like playing offense.

On the flip side, “risk off” is like playing defense. With a risk-on approach, investors are trying to “score” – or increase their profits. But a risk-off approach focuses on stopping or limiting losses.

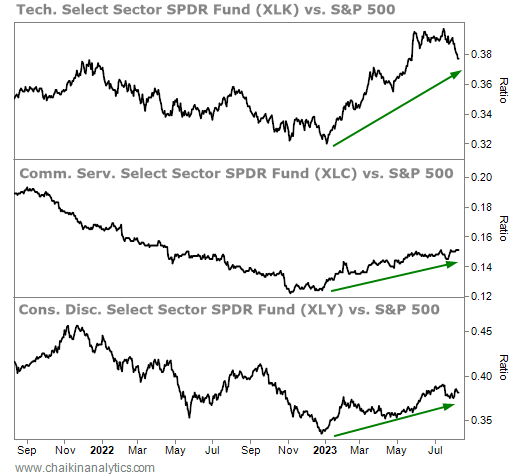

Now that we’re on the same page, here are my top three risk-on sectors…

• Technology Select Sector SPDR Fund (XLK)

• Communication Services Select Sector SPDR Fund (XLC)

• Consumer Discretionary Select Sector SPDR Fund (XLY)

This play in my risk-on playbook consists of tracking the trends of these three sectors. These sectors are full of the growth stocks that investors turn to when they’re willing to take on more risk.

It’s like how a scout watches the next opponent of a college football team. The scout goes to the opponent’s games to find the players that his team needs to focus on defending.

In this case, I’m also always scouting against the benchmark S&P 500 Index using the SPDR S&P 500 Fund (SPY). That brings us to the three-paneled chart below…

Now, this chart looks more complex than a basic stock chart. But it’s easy to understand…

The top panel shows XLK’s ratio against SPY. That just means XLK is divided by SPY to form a ratio. When the ratio is moving up, XLK is outperforming SPY – and vice versa.

The same thing is true for the other two panels in the above chart, except they show the performance of XLC and XLY versus SPY.

You’ve probably never noticed the word “versus” in finance before. But by comparing these risk-on sectors versus SPY, we can see that they’re all currently in uptrends.

In other words… the offense is on the field right now.

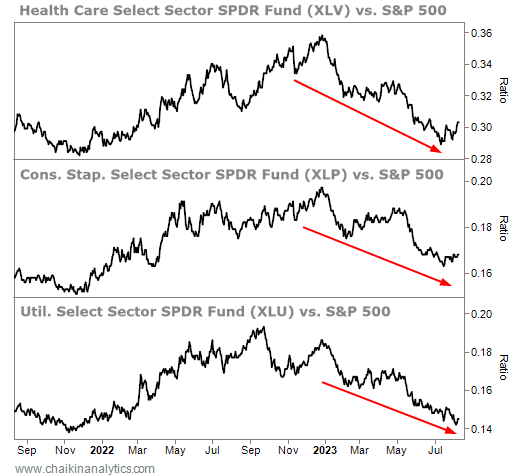

When the offense is on the field, the defense isn’t. And when we look at a similar chart of three typical “risk off” sectors, you can see that’s true today…

The top panel shows the ratio of the Health Care Select Sector SPDR Fund (XLV) versus SPY. In the middle, it’s the Consumer Staples Select Sector SPDR Fund (XLP). And the Utilities Select Sector SPDR Fund (XLU) is in the bottom panel.

These sectors are considered risk-off areas of the market because they’re less about growth and more about safe returns. Since these sectors all deal with our everyday needs in one way or another, they’re good places to shelter from a market storm.

As you can see, all three risk-off sectors are in obvious downtrends right now.

So our takeaway is clear…

Using my playbook for risk, it’s obvious that investors are willing to take on more risk today. And they’re not as concerned about playing defense.

But keep in mind…

When the risk-on approach is in an uptrend like right now, pullbacks can still occur. The difference is that you can view them as buying opportunities instead of reasons to get out.

Good investing,

Pete Carmasino