The market looks very different today than it did just a few months ago…

The broad market S&P 500 Index is firmly above its long-term trend line. And the same thing is true about the tech-heavy Nasdaq Composite Index.

But retail investors aren’t buying it. They’re panicking out of stocks and into cash.

Seriously…

We continue to see signs of the next great bull run. And yet, retail investors are turning away and running for the exits.

Today, we’ll discuss why that’s a big mistake…

Retail investors are moving to cash at one of the fastest rates I’ve ever seen.

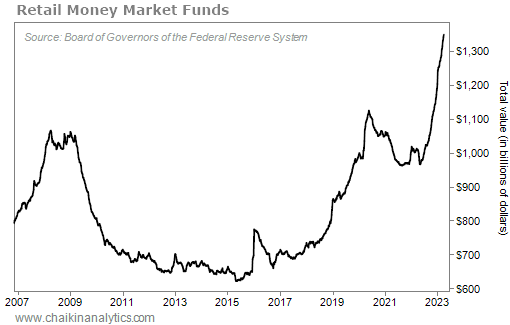

The following chart shows the total value of “retail money market funds” in the U.S. It’s based on Federal Reserve data.

Money market funds hold your cash after you deposit it into your brokerage account. They also hold the cash in your brokerage account when it’s not invested in anything else.

This chart goes back to before the financial crisis. And as you can see, the amount of cash in retail investors’ money market funds is soaring right now. Take a look…

This data could just mean that retail investors have more cash than ever. That’s not necessarily a bad thing on its own. But the picture gets worse with more data…

You see, individual stock purchases have fallen nearly in half since mid-February. And household net worth is still down from its peak in the first quarter of 2022.

Now, I realize that might make sense on an individual level…

After all, the latest data shows that we’re dealing with below-peak household wealth. So I could see why a lot of folks might fear a recession or layoffs and want to hoard cash.

Unfortunately, retail investors are making this move in the middle of a market recovery…

Remember, tech stocks were the source of major pain last year. But now, they’re on the upswing…

For example, the Nasdaq is up more than 15% in 2023.

That’s a big move in a short span. And retail investors are missing out because they’re scared.

Regular readers know that I’ve covered the next leg of the bull market in detail…

We’re still seeing signs that stocks are gaining strength. And even better, it looks like the financial system is shaking out the risk-taking missteps that led to the banking crisis…

JPMorgan Chase (JPM) CEO Jamie Dimon addressed this idea while talking about his company’s takeover of First Republic Bank (FRC) on Monday. Specifically, he said, “There are only so many banks that were offsides this way… This part of the crisis is over.”

Retail investors are making a costly mistake. And they could easily avoid it with the help of the Power Gauge.

The S&P 500 and the Nasdaq both earn “bullish” or better ratings today.

In the end, it looks like retail investors are just behind the curve again…

They’re stuck on the story of the banking crisis. And they’re not paying attention to the brute-force data that shows we’re entering the next leg of the bull market.

Don’t follow the crowd and run for the exits.

Good investing,

Marc Chaikin