Regular Chaikin PowerFeed readers know all about the Power Gauge…

The system itself isn’t a secret. It’s an easy-to-use, readily available software platform.

But here’s something you might not realize…

Hidden treasures live within the pockets of data inside the Power Gauge.

You see, the system stores a ton of data on more than 5,000 stocks and exchange-traded funds (“ETFs”). It updates this data every day the markets are open.

And at Chaikin Analytics, we use all that data to create what I like to call our “secret lists.”

I won’t give away too much about these secret lists today. But I do want to share all the details of a recent alert from one of the lists about a beleaguered bank stock…

This stock was already down about 90% since early February. But after it popped up on our secret list earlier this week, it plunged another 64%. And now, it’s on the brink of collapse.

Let’s dig in…

As you know, the Power Gauge includes four main categories…

- Financials

- Earnings

- Technicals

- Experts

Each category includes five different factors.

The Power Gauge pulls together the data from all 20 factors. And it produces an overall grade for every stock and ETF in its universe.

We use some of the Power Gauge’s factors to create our secret lists. And one of these secret lists is called “Factor Movers”…

It drills down into four of the factors within the Experts category – short interest, insider activity, earnings estimate trend, and analyst rating trend.

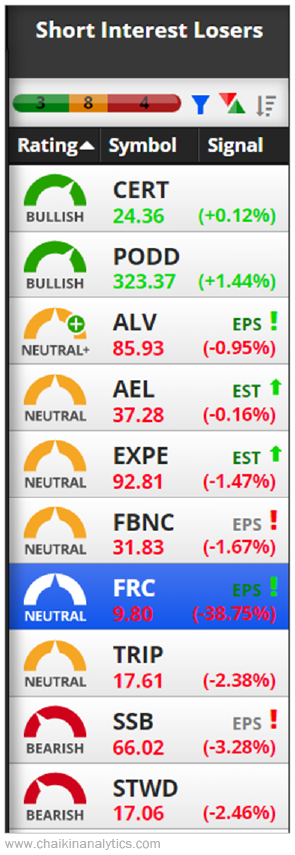

One of the list’s subcategories that updates daily is “Short Interest Losers.”

Specifically, it refers to the level of short interest on a stock becoming more “bearish.” In other words, it means savvy investors are increasingly betting that the stock will fall even further.

On Tuesday, a now-ubiquitous name to most investors popped up on our Short Interest Losers list. I’m talking about beaten-down bank stock First Republic Bank (FRC).

Take a look…

First Republic was relatively unknown to most investors about two months ago. But when Silicon Valley Bank collapsed in mid-March, all eyes turned to other troubled banks.

In early February, First Republic closed as high as $147 per share. It was around $16 per share on Monday afternoon. That’s roughly 90% below its high. And it got worse Tuesday…

The company’s quarterly conference call didn’t go well.

First Republic reported that its deposit balances fell about 41% from the previous quarter. That means more than $100 billion left the bank over that period.

The company missed terribly on earnings, too. And that wasn’t the worst part…

You see, First Republic broke an unwritten rule of Wall Street. The conference call only lasted about 12 minutes. And the executives didn’t take any questions from analysts.

Folks, that’s as big of a red flag as you’ll ever find…

Companies that refuse to take questions from analysts are typically hiding something. And sure enough, the “something” it was hiding came to light later that day…

In short, First Republic needs to sell up to $100 billion in assets to survive. And that’s a tough task in the current environment. As a result, its stock fell to less than $6 per share.

(Astute readers will realize that my colleague Briton Hill mentioned Tuesday that the Power Gauge was in “wait-and-see mode” on First Republic. I hope you listened to his message.)

The bottom line is simple…

We discussed a powerful secret list today. But it’s not actually secret for most of our Chaikin Analytics subscribers. Like the system itself, it’s readily available to these folks.

Does your current system or process help you uncover hidden treasures like this?

If not, it’s a great time for you to add the Power Gauge to your investing toolkit.

Good investing,

Pete Carmasino