The “smart money” is on the move…

Regular readers know we’re referring to institutional-level traders and fund managers. They’re the big guys in the investing world. So it’s critical for us to always know what they’re doing.

And right now, these smart-money traders are piling into one group of “defensive” stocks – consumer staples.

These companies’ goods or services will sell well even if the economy struggles. Because of that, they provide great defense for investors in a downturn.

My colleague and Chaikin Analytics CEO Carlton Neel outlined this idea on Monday. So you already know where to look. But that leads us to another basic question…

What does it mean for the rest of the market?

Folks, this one is going to get a little grim…

Over the past six months, the Consumer Staples Select Sector SPDR Fund (XLP) is up roughly 7%. This exchange-traded fund (“ETF”) is packed full of defensive companies…

Its top five positions are Procter & Gamble (PG), PepsiCo (PEP), Coca-Cola (KO), Costco Wholesale (COST), and Philip Morris International (PM). The ETF also holds other big names like Walmart (WMT), General Mills (GIS), Hershey (HSY), and Colgate-Palmolive (CL).

Consumers won’t stop buying from these companies unless the world comes crashing down. The products they sell are “essentials” – like toilet paper, cereal, and toothpaste. That’s what makes them perfect defensive investments in hard times.

The S&P 500 Index, our broad measure for the stock market, is only up around 3.5% over the same six-month period. In other words… consumer staples are outperforming the market.

That’s a darn ominous sign. And as Carlton explained on Monday, the smart money is binging on consumer staples stocks right now, too.

That tells us these big guys in the investing world are seeking shelter from a potential storm.

Now, I should be clear… That doesn’t mean a major crash is imminent.

But it does mean that Wall Street’s brightest minds think now is a good time to prepare for one. And when that happens, you better make sure you’re preparing, too.

Fortunately, consumer staples stocks are a great way to do that…

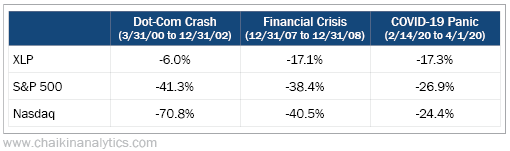

The following table shows how XLP, the S&P 500, and the tech-heavy Nasdaq Composite Index all fared during three major sell-offs over the past couple of decades. Take a look…

This data makes it clear… When the market falls apart, consumer staples hold their footing.

Sure, the sector fell during those three major sell-offs. But in each case, the declines weren’t as bad as the incredible butt-kickings for the broad market and tech stocks.

Now, the smart money is preparing for another storm. It’s piling into defensive stocks like consumer staples.

We can’t know if the storm will happen tomorrow, next week, or even months from now.

But whenever it happens, history shows us that this isn’t a signal to ignore. During three major sell-offs over the past couple of decades, XLP held up much better than the broad market and tech stocks.

So if the market is about to fall, make sure you’re in line with the smart money.

Good investing,

Marc Gerstein