Darn near everything has been getting more expensive.

And most consumers think it’s just greedy companies jacking up prices.

But one corner of the market tells a different story…

I’m talking about auto insurance.

I can already hear you groaning. Everyone’s car insurance bills have skyrocketed. And it feels easy to paint insurance companies as the “bad guys.”

But the truth is that it has been a crazy couple of years in the auto insurance space.

You probably know the basic details already. It started with a massive surge in used-car prices following the pandemic.

At their peak in early 2022, used-car and truck prices were up 55% from pre-pandemic levels, according to data from the U.S. Bureau of Labor Statistics (“BLS”).

Now, the used-car bubble is starting to pop (or at least deflate). Prices are down roughly 15% from their peak.

Nevertheless, the wild price surge wreaked havoc on auto insurers. So today, I’ll explain what happened…

Keep in mind that these companies are always walking a tightrope.

They want to offer lower prices than their competitors. But they also need to collect enough money to cover the cost of paying out for claims.

When car values rise too fast, auto insurers end up paying out a lot more than they previously expected. Suddenly, accidents are way more expensive than they were a year ago.

But it isn’t just car values that have soared. Vehicle maintenance and repair costs are up more than 30% from pre-pandemic levels.

In other words, insurers are getting hit with higher bills every time a customer submits a claim. The damages are bigger. And the repair costs are surging.

Of course, no one feels bad for insurance companies. But you can understand why they’ve been raising their prices.

Allstate (ALL) and Travelers (TRV) raised their auto premiums more than 16% in 2023. Zurich Insurance, which operates Farmers Insurance in the U.S., said it raised auto premiums nearly 20% last year.

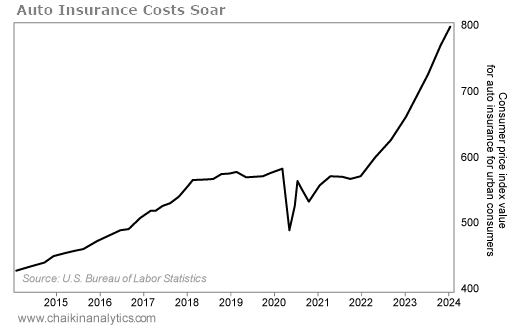

These numbers match what we’re seeing from recent U.S. inflation data. According to the BLS, the cost of auto insurance jumped 14.2% in 2022. That was followed by another 20.3% surge in 2023.

The chart below shows the consumer price index for auto insurance for urban consumers. In it, you can see the sharp move higher in recent years…

But here’s the interesting part…

Despite the big price hikes, most auto insurers are still losing money.

To prove it, we need to look at some financials…

Insurance businesses measure their profitability using a single metric – the “combined ratio.”

Put simply, this number is “money paid out” (claims) divided by “money taken in” (premiums). A ratio above 100% means the company is losing money. It’s paying out more on claims than it’s collecting in premiums. And if the ratio is below 100%, the business is turning a profit.

According to European insurance giant Swiss Re, based on profitability, 2022 was the worst year for auto insurers since 1975.

The combined ratio for the industry was 112%. That means companies paid out $112 for every $100 they collected in premiums.

Not surprisingly, big U.S. insurers like Allstate and Travelers have also struggled. Both have consistently posted combined ratios above 100% over the past two years.

But the worst appears to be over…

During the fourth quarter of 2023, Allstate’s auto insurance unit turned profitable for the first time since 2021. Travelers is still losing money, but its losses have been declining since the mid-2022 peak.

Meanwhile, Swiss Re says it expects the recovery to continue in 2024. After two years of price hikes, the industry is finally bringing in enough money to cover the jump in claims costs.

This situation is a solid reminder that too much inflation is terrible – for consumers and companies.

A lot of folks like to blame rising prices on “corporate greed” alone.

But the truth is that your auto insurer isn’t gouging you – at least not yet. It probably hasn’t turned a profit in years.

Still, it’s probably a good idea to shop around as the industry recovers in 2024.

Good investing,

Vic Lederman

P.S. As I said, darn near everything has been getting more expensive. And as we all know, inflation isn’t the only cause for uncertainty right now…

Interest rates are still high. War is raging overseas. We’re still hearing recession warnings in the media. And if that wasn’t enough, we’re also in a presidential-election year.

That’s why tonight, at 8 p.m. Eastern time, Chaikin Analytics founder Marc Chaikin is going on camera for a special broadcast. During it, he’ll explain the critical, election-year event headed straight for U.S. stocks. He’ll also share the urgent move you need to make to prepare for it.

Don’t be blindsided by what Marc says is coming. Register to attend his free event tonight – and learn more about what’s on the agenda for this evening – by clicking here.