The latest numbers are in…

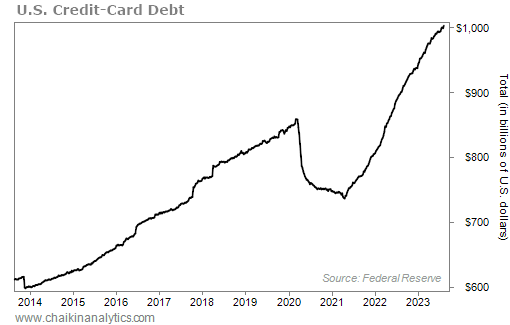

U.S. credit-card debt just hit $1 trillion for the first time.

Yes, I said “trillion” with a “T.” That’s a lot of high-interest debt.

And of course, the mainstream media is painting a grim picture…

Many news outlets are focused on how this record-setting level of credit-card debt combines with higher interest rates. They believe it could lead to an uptick in delinquencies.

That development wouldn’t be good for the U.S. economy.

But as I’ll show you today, the reality isn’t as bad as it seems. We’re not seeing widespread consumer distress. And ultimately, the record level of credit-card debt is a good thing…

It’s true that credit-card debt has soared over the past couple of years. And as I said, it just breached $1 trillion at the end of last month. Take a look…

The record amount of credit-card debt is partially due to the COVID-19 pandemic.

And no, I’m not referring to people needing to pay for things with credit cards because of their poor economic choices. Instead, I’m talking about the “cashless” boom…

You see, many folks feared that cash could transmit COVID-19.

As a result, many businesses went entirely cashless during the pandemic. For example, quick-service restaurants Chick-fil-A, Shake Shack, Sweetgreen, and Noodles & Company stopped accepting cash in at least some of their locations in 2020.

Most companies went back to accepting cash after the worst days of the pandemic. But it doesn’t change the fact that consumer behavior shifted in a big way…

More people than ever are now using cashless forms of payment. And ultimately, this trend goes far beyond COVID-19…

Nearly half of all U.S. credit-card users opened at least one new account in 2022. And a good chunk of those folks come from the tech-friendly millennial and Generation Z crowds…

Millennials alone have $2.5 trillion in spending power. And according to a March study from industry expert ESW, they’re projected to lead all e-commerce spending in 2023.

Here’s the thing…

Record credit-card debt is a sign of resilience in younger consumers.

Simply put, it means these younger generations are spending money.

And credit-card companies aren’t reckless when they offer credit limits. Most companies check your credit report. And they’ll also verify your income level to determine your limit.

So it’s safe to say that this spending doesn’t mean the economy is crippled – not even close.

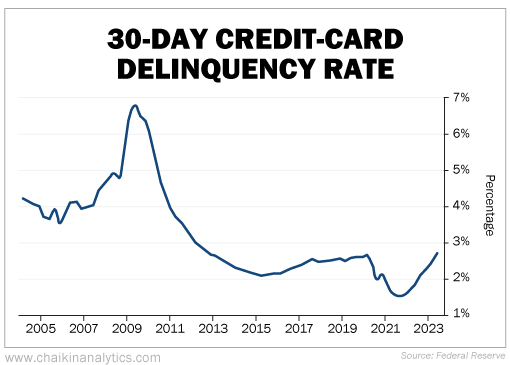

Record levels of credit-card debt will likely lead to a higher number of delinquencies. That’s just a fact of life as more folks use credit cards.

But as long as the delinquency rate doesn’t soar, things will be OK. And according to Federal Reserve data, only about 3% of credit-card holders are currently more than 30 days late…

You can see that we’re still a long way from the peak of more than 6.5% in 2009.

So for now, rising credit-card debt isn’t a major concern. Instead, we should look at it as a good thing…

American consumers are doing just fine. They’re simply using “convenient” cashless payment methods – especially online.

Folks, remember this point…

The mainstream media is paid per click. And the scariest-sounding articles often get the most hype.

But in reality, we’re in a bull market. The U.S. economy has proven its resilience.

Don’t fall victim to the fear.

Good investing,

Briton Hill

P.S. Rising credit-card debt isn’t the only “scary” headline in the news recently…

Less than two weeks ago, Moody’s took various actions on 27 U.S. banks. And the credit-ratings agency put six big banks on review for potential downgrades – including U.S. Bancorp, Bank of New York Mellon, and Truist Financial.

Not surprisingly, readers have asked if they should get ready for another wave of bank failures.

So we reached out to Chaikin Analytics founder Marc Chaikin. We asked whether the recent downgrades are a sign of concern, as well as what he’s seeing in the Power Gauge today.

Marc was kind enough to provide a brand-new, five-minute update from his Connecticut home. He shared exactly what he believes will come next for U.S. banks and the market. Plus, he detailed a unique way that you can harness today’s volatility for quick gains.