Folks, one of the top-level market sectors is in trouble this year…

I’m talking about utilities.

In the Power Gauge, we track this sector with the Utilities Select Sector SPDR Fund (XLU). And put simply, it’s not going well for this basket of stocks.

XLU has lost about 1% since the start of the year. On the other hand, the broad market S&P 500 Index has soared nearly 8%. And the tech-heavy Nasdaq Composite Index is up about 8%.

That makes XLU the worst-performing sector in the Power Gauge. But for regular Chaikin PowerFeed readers, the struggle in utilities is no surprise.

Today, let’s take a closer look at why that is – and what our system sees ahead for XLU…

Regular readers might remember that I wrote about XLU back in early September. At the time, the fund was doing terribly. Up to that point, it was down about 13% in 2023 and was down roughly 20% over the previous year.

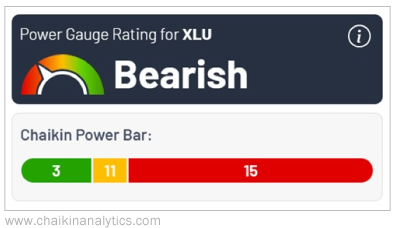

And as I said earlier in today’s essay, XLU is still struggling. We can see that using the Chaikin Power Bar.

The Power Bar ratio is a “quick glance” tool…

It breaks down all the stocks with Power Gauge rankings within an exchange-traded fund (“ETF”). They’re color-coded as “bullish” or better (green), “neutral” (yellow), or “bearish” or worse (red). And with just a glance, we can get our system’s overall take on an ETF.

In XLU’s case, the outlook is grim right now. Take a look at this screenshot from the Power Gauge…

As you can see, XLU has an overall “bearish” Power Gauge rating right now. It only features three stocks with a “bullish” or better rating. And 15 stocks in the ETF earn “bearish” or worse grades.

Back in September, XLU only had one stock with a “bullish” rating and 22 stocks with “bearish” or worse grades. That means today’s numbers are a slight improvement, but this isn’t enough to move the sector out of “bearish” territory.

Right now, the utilities sector is still the worst-ranked in the Power Gauge. XLU ranks 11th out of 11 sectors in terms of the Power Bar ratio.

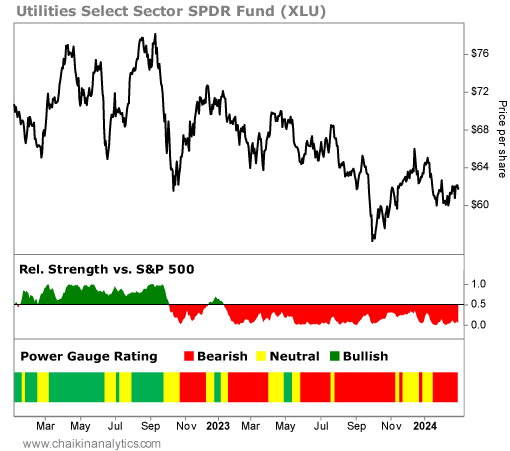

Fortunately, the “bearish” turn was as clear as it gets in the Power Gauge. Take a look…

As you can see, XLU was choppy but strong through most of 2022. It also held a “bullish” rating for most of the year.

But later in 2022, something changed. The sector stumbled.

It switched from outperforming the broad market to underperforming it. And the Power Gauge quickly flashed “neutral”… and then “bearish.”

Since then – and through most of 2023 – XLU has held a “bearish” rating. And 2024 isn’t looking any better.

XLU has maintained its “bearish” rating since the start of the year.

The rating in the Power Gauge is still clear… Utilities are not the defensive play you’re looking for right now.

Good investing,

Vic Lederman

P.S. Spotting potential traps like XLU isn’t the only thing the Power Gauge can do…

In fact, Chaikin Analytics founder Marc Chaikin is using the Power Gauge to track an election-year event that he says is headed straight for U.S. stocks. And he’s tracking it with 90% accuracy in our system.

That’s why Marc just put together a brand-new presentation. It details the unusual volatility an election year can bring – and what he says you need to do about it. He also shares two recommendations you can act on now.

Get the details – and hear Marc’s one crucial step to take with your money well before the presidential election – right here.