Last week’s inflation data surprised a lot of folks…

On Wednesday, the U.S. Bureau of Labor Statistics released its Consumer Price Index (“CPI”) report for March.

In short, the numbers came in above expectations. So-called “headline” inflation was up 3.5% year over year. And “core” inflation (which ignores food and energy costs) showed that prices rose 3.8% compared with the same period a year ago.

This “hotter than expected” inflation data triggered a sell-off in stocks and bonds.

The S&P 500 Index fell nearly 1% on Wednesday. Meanwhile, the small-cap Russell 2000 Index plunged 2.5%. And sinking bond prices sent yields to their highest levels since November.

The reason for the weakness is simple…

“Sticky” inflation makes it less likely that the Federal Reserve will cut interest rates anytime soon. And since lower rates are positive for stock prices, it creates a short-term negative as investors adjust their expectations.

I know this kind of volatility can be scary. But regular Chaikin PowerFeed readers likely weren’t surprised by the sell-off…

As I warned last week…

Negative surprises in economic data releases can trigger even more volatility in the short term.

Well, Thursday’s Producer Price Index (“PPI”) release was in line with expectations. But CPI numbers were higher than expected.

So let’s take a quick look at the CPI numbers to see if there’s anything investors should be worried about…

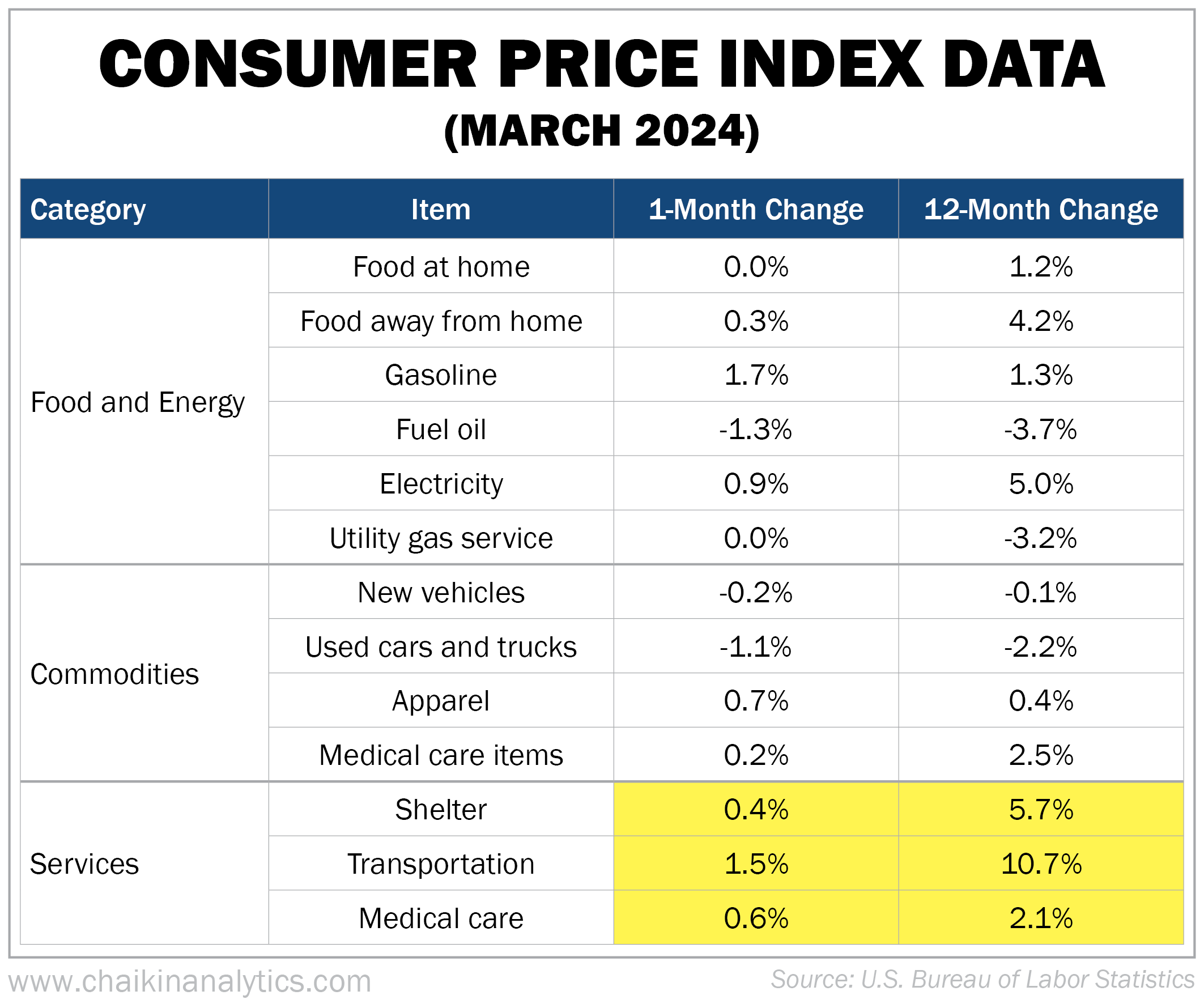

I’ve highlighted the numbers in the “services” category because they’re the ones that came in above expectations. Everyone knew gasoline prices would be up sharply. And inflation is relatively modest for things like food, cars, and clothes.

As you can see in the table above, services are where we’re seeing particularly stubborn inflation.

But while the rising prices are frustrating for consumers, they’re also a sign of a strong economy.

Most services costs go directly into the pockets of companies and their employees. That means higher earnings (for companies/stocks) and higher wages.

In other words, the data shows the U.S. economy is in great shape.

A lot of folks are complaining about inflation. But they’re still spending money.

So don’t be distracted by the “Fed chatter.” The media loves to obsess over every detail of the Fed’s plans for interest rates…

But that’s not how investors make money in the stock market.

As I also said last week…

Rising earnings and expectations drive stock prices higher – not interest-rate cuts.

And if it takes longer than expected for inflation to hit the Fed’s 2% target, that’s OK. Those higher prices will translate into earnings growth for companies in the stock market.

So I’m still “bullish” on stocks for 2024. And I encourage you to stay “bullish” as well.

Good investing,

Marc Chaikin