Fast-food chain Wendy’s (WEN) was in damage-control mode last week…

Early in the week, the media picked up on the company’s potential plans to eventually introduce “surge pricing” at some of its restaurants. (Wendy’s CEO used the phrase “dynamic pricing,” which I’d argue means the same thing.)

In short, surge pricing is when a business adjusts prices based on demand throughout the day. It’s a common strategy for companies like Uber Technologies (UBER) – which raises rates for its taxi service during rush hour.

But it’s a questionable approach for a restaurant. No one wants to see menu prices rise as they’re waiting in line to order lunch.

And as you would expect, it didn’t take long for the backlash to erupt…

Social media users slammed Wendy’s for its tone-deaf pricing plan. As one user said bluntly in a post on Reddit last week…

Just so I am clear on this. The price goes up the longer the line. So I need to pay more to wait longer?

And the news attracted plenty of political commentary. For example, Senator Elizabeth Warren jumped at the chance to post about it on X (formerly Twitter)…

It’s price gouging plain and simple, and American families have had enough.

Faced with the outrage, Wendy’s quickly backtracked. And the company’s PR department has spent the past few days on the defensive. As Wendy’s said in a blog post on its website…

This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants. We have no plans to do that and would not raise prices when our customers are visiting us most.

A Wendy’s spokesperson also noted the company never officially used the term “surge pricing” to describe the new strategy. (Again, the CEO used the phrase “dynamic pricing” – to me, that means the same thing.)

At this point, the damage has been done. The backlash probably won’t create a noticeable dent in Wendy’s sales. But it has certainly eroded the company’s reputation. And angering your customer base is never a good idea.

From an investment perspective, it’s impossible to predict a PR disaster like this. But as I’ll explain, the bad news isn’t entirely surprising…

You see, Wendy’s stock has been treading water for years.

That’s somewhat surprising, since the company has posted steady growth in both revenue and profits.

Over the past four years, the company grew sales by more than 6% per year. And net income grew around 10% annually over the same time frame.

Last year, sales at Wendy’s locations in the U.S. grew 5.1%. That’s down from 5.3% growth in 2022.

Despite Wendy’s growth numbers, the Power Gauge noticed some alarming red flags…

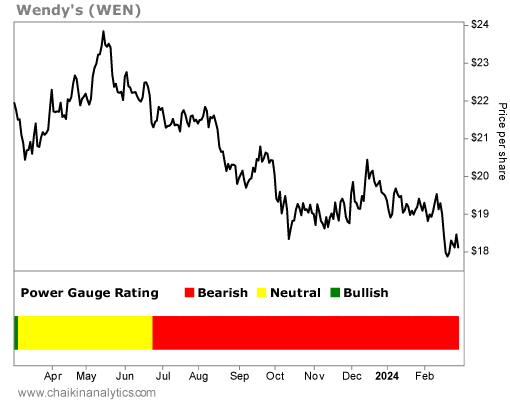

It turned “bearish” on Wendy’s in late June 2023. Since then, the company has remained “bearish” or worse. And in the meantime, WEN shares have plunged 20%. Take a look…

In fact, the Power Gauge gives Wendy’s “bearish” or worse ratings in three out of the four major categories – Financials, Technicals, and Experts. And in the Earnings category, Wendy’s only ekes out a “neutral” rating.

For example, the company has high debt and low free cash flow (“FCF”) compared with its market cap.

And if we dig deeper, we see the stock gets negative grades across multiple metrics. These include insider activity, earnings surprises, relative strength versus the rest of the market, and analyst estimates and ratings.

In Wendy’s case, no one could’ve predicted last week’s PR disaster.

But the Power Gauge had already noticed the company’s issues. It constantly updates 20 different factors for more than 5,000 stocks. That means it can spot the early warning signs – like when a stock starts to badly underperform the broader market.

By spotting the red flags at Wendy’s, the Power Gauge was able to alert us before the big declines in recent months.

The lesson here is simple…

“Bearish” companies are prone to missteps. They’re looking for ways to right the ship. And turnaround strategies come with risks.

Wendy’s is a perfect example of this.

Will the company find the right strategy eventually? I believe it will.

But today, the Power Gauge is clear. Wendy’s is in a “very bearish” position.

Good investing,

Vic Lederman

P.S. Right now, Chaikin Analytics founder Marc Chaikin has leveraged the Power Gauge to issue his next big market prediction. In short, he says it’s a critical election-year event headed straight for U.S. stocks.

This past Thursday, Marc went on camera to explain the full story. He shared what it all means for your money in the coming weeks. And he shared his stock market road map for what’s ahead. Don’t be left in the dark – you can still catch the replay of Marc’s broadcast by clicking here.