You’re bound to stumble upon recession-related articles in the financial media these days…

Most of these articles are warning investors of an “impending” recession.

The problem is… we already had a recession.

Technically, at least.

You see, historically, a recession has been defined as two straight quarters of declining gross domestic product (“GDP”). Here in the U.S., who happened early last year.

But today, I want to take a closer look at that “recession.” And more importantly, we’ll investigate what it means for us as investors going forward…

In short, as I said, U.S. GDP was negative for two quarters in a row last year…

It dropped 1.6% during the first quarter of 2022. Then, it fell another 0.9% in the second quarter.

That’s the standard definition of a recession. And when it happened, many economic analysts called for an official announcement…

But instead, Uncle Sam pivoted. The government basically said, “Well, it’s much more complicated than that.”

Now, I know a number of factors contribute to a recession. But that doesn’t change the fact that all financial pros have long considered two quarters of falling GDP to be a recession.

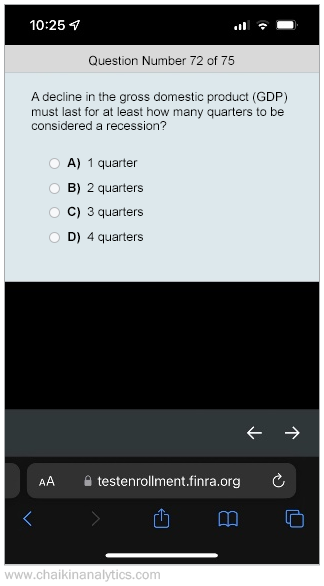

We’re even quizzed on it. Take a look at the following screenshot…

I took this screenshot from my cellphone on August 4, 2022.

It was a practice test for an exam from the Financial Industry Regulatory Authority (“FINRA”). If you don’t believe me, just check out the URL at the bottom of the screenshot.

FINRA definitely knows a thing or two about the financial industry. And they’re responsible for the exams every investment adviser takes before managing money for clients.

For anyone wondering, the correct answer was “2 quarters” as recently as last August.

I took the screenshot at the time because of all the chaos surrounding the definition. But even then, the FINRA exam had a clear definition…

Two quarters of falling GDP defines a recession.

So that means we had a recession last year. And yet, analysts have argued ever since Uncle Sam made the pivot…

It got so bad that editing the Wikipedia page for “recession” was temporarily suspended.

The experts just can’t come to terms anymore.

Unfortunately, it’s leaving a confusing mess for consumers to sort through. And it’s distracting investors from the newly born bull market.

But here’s the thing…

Rather than ask “when” it’s going to happen, I’m asking “what if it already happened?”

By the standard definition, we’ve already had a recession. And stocks are up significantly since then.

The mainstream media will continue to drum up confusion. And everything you read will point to a million reasons why the recession is in the near future.

But history tells us it’s in the rearview mirror. And the market is validating that stance.

Stay optimistic. Good times are ahead.

Good investing,

Briton Hill