You’ll rarely ever meet someone who wants to turn down more cash in their pocket…

But that’s exactly what I want to do right now.

Inflation is still higher than normal. And credit-card debt keeps hitting record levels.

Uncle Sam is paying close attention to those two problems today. And he’s proposing new regulations that could put thousands of dollars into the pockets of U.S. consumers.

But there’s a problem…

It’s not happening the way you might think.

In short, Uncle Sam is taking aim at credit-card companies like Visa (V) and Mastercard (MA). And the proposed regulations are so big that they could dramatically reshape the entire market…

First, I’m sure you’ve heard that U.S. credit-card debt is out of control…

This type of debt topped $1 trillion for the first time in late July.

Now, surpassing $1 trillion in credit-card debt isn’t the biggest problem. As we said in the Chaikin PowerFeed in August, in real terms, that figure isn’t as bad as it seems at first.

That’s because inflation has eroded our purchasing power in recent years…

When we account for inflation, $1 trillion today is the equivalent of $800 billion in 2020. And in real terms, that means U.S. credit-card debt is roughly the same as three years ago.

The real problem is the “delinquency rate” on U.S. credit-card debt. That’s simply the percentage of credit-card debt past due by 30 days or more.

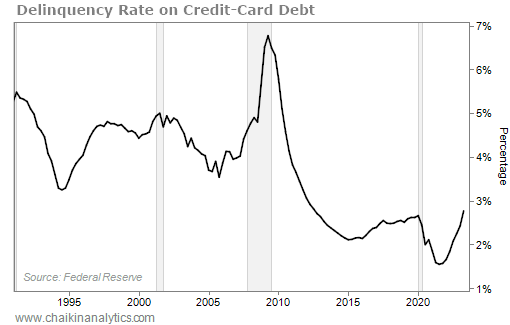

The Federal Reserve keeps official data on the delinquency rate in the U.S. And as you can see in the following chart, this rate has been climbing at a rapid pace recently. Take a look…

At a glance, you’ll notice that the delinquency rate is still nowhere near a record high. This rate peaked at roughly 6.8% in 2009. And today, it’s only around 2.8%.

But notice what has happened over the past couple of years…

The delinquency rate is up sharply from its 2021 bottom. Back then, it was around 1.5%.

The current uptick is clear on the chart. And even worse, due to elevated inflation in recent years, many folks fear that the delinquency rate will keep climbing in the coming quarters.

Uncle Sam is now getting involved…

In short, the government is proposing new regulations to cap the fees that credit-card companies can charge. The government’s plan involves two parts…

The first part is the Credit Card Competition Act of 2023. This proposed law aims to force credit-card companies like Visa and Mastercard to allow businesses to process transactions on other, cheaper networks.

The second part is the Fed’s plan to cut credit-card processing fees. Put simply, the central bank believes these fees are too high. So it wants to slash them in half.

That’s terrible news for credit-card companies. And here’s why it matters to you…

Credit-card companies will need to adjust their business model to counter the loss of a ton of revenue from fees. As a result, well-meaning consumers could suffer…

Some experts expect the new rule to punish people who pay their bills on time.

Simply put, folks who pay their credit-card bills on time will be subsidizing late payers.

Instead of credit-card companies charging late fees, they’ll be forced to raise annual fees. And they’ll likely cut the perks that many credit-card users love – like cashback rewards.

Credit-card companies are concerned that many cardholders who pay their bills on time will cancel their credit cards due to the increased fees.

If that were to happen, consumers will have no choice but to start using more cash again…

You see, many people enjoy the perks and ease of credit cards. But if those perks went away and the fees to use the card soared, many folks would likely cancel.

Businesses might even raise their prices. That would become even more likely if credit-card companies need to charge more for processing fees to accommodate all the late payers.

So when I say that Uncle Sam is proposing rules to put more cash in your pocket…

It’s happening, but not the way you’d like.

I don’t want more cash in my pocket if it happens like that. I hope the changes don’t pass.

Good investing,

Briton Hill