Editor’s note: Back in January, Chaikin Analytics founder Marc Chaikin told readers to expect the U.S. housing market to “stay tight.” That means continued high prices for homes.

And over at our corporate affiliate Stansberry Research, our friend Brett Eversole recently found more evidence that housing prices will stay higher…

Today’s essay is from the May 30 edition of Brett’s free DailyWealth e-letter. In it, he explains why an important measure for homebuyers means housing prices could keep rising in the months to come…

U.S. housing just might be the most resilient asset market in the world…

The post-pandemic era should have sunk the industry. The hits started coming as the global economy ground to a halt… And they never slowed down.

First, home inventory evaporated just as the number of potential buyers exploded. Prices spiked to what seemed like unsustainable highs.

Next, interest rates soared. Then mortgage rates followed, hitting their highest levels in more than two decades. Affordability got crushed.

Anyone back in 2022 would have told you a housing collapse was imminent. Well, housing activity collapsed… But for prices, the crash never came.

Today, U.S. home prices are hitting new all-time highs again. And as I’ll explain, we should expect this bull market to continue… thanks to a critical measure for homebuyers.

Every bullish factor turned sour in the housing market almost overnight. The doom and gloom refused to lift in recent years. It should have been the end for housing…

Instead, this market held up better than anyone expected. And now, despite the multiple headwinds, U.S. housing is back at all-time highs.

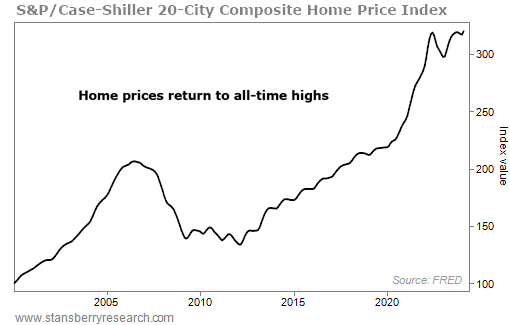

We can see this in the S&P CoreLogic Case-Shiller 20-City Composite Home Price Index. This benchmark for home prices comprises the 20 largest housing markets in the U.S. Take a look…

This measure dropped 7% from June 2022 through January 2023. But it has recovered since that slight decline. Now, U.S. housing prices have returned to all-time highs.

We can expect prices to keep rising in the months to come, too. That’s because housing has continued to climb in spite of a collapse in affordability.

Even better, though, we’re finally seeing a turnaround in the latter…

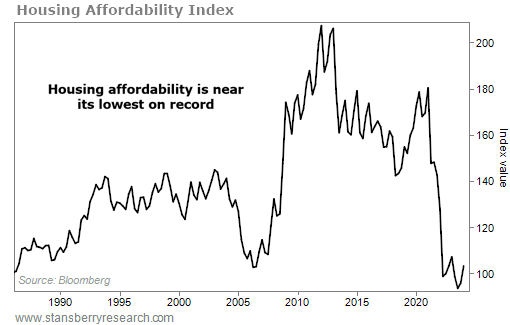

Housing affordability is measured with three variables: home prices, household incomes, and mortgage rates. Home prices and mortgage rates tell us what the typical housing payment looks like… And incomes tell us if folks can afford it.

When home prices and mortgage rates spiked in recent years, housing affordability plummeted. It swung from almost record highs to a record low, according to the National Association of Realtors’ Housing Affordability Index. Take a look…

The important level for this index is 100. At 100, a median-income household can afford a median-priced home in the U.S. A reading of 150 means a median income can cover 150% of a median home price.

Before the pandemic-induced housing mania, the index was at 180. It might not have felt like it at the time… but almost anyone could afford a house back then.

The easy times for housing disappeared fast. Just last year, affordability fell below 100 for the first time on record. But that’s already beginning to reverse…

Affordability jumped to 103.3 in March. That’s still low. But it’s 10% better than the lows of 2023. The trend is moving back in favor of homebuyers.

This is a bullish sign for the health of the housing market. It could help sustain the rising prices we’ve seen in recent months.

Simply put, if betting against housing was wrong two years ago, it’s completely foolish to do the same today. And with affordability rising, we can expect the new highs to continue in the months ahead.

Good investing,

Brett Eversole

Editor’s note: In his DailyWealth e-letter, Brett aims to share the world’s best wealth ideas with his readers. These strategies are designed to help folks safely and steadily build a lifetime of wealth.

Just like the Chaikin PowerFeed, DailyWealth publishes in the morning every weekday the markets are open. And it’s 100% free of charge. To learn more about DailyWealth and sign up to receive it, click here.