You’ve probably heard the acronym “TINA” before…

It stands for “There Is No Alternative.” And in this case, it refers to the stock market.

In many ways, TINA was the key to long-term success since the last financial crisis ended in 2009…

Folks saving for retirement had no alternatives to grow their wealth. They needed to stick with stocks for longer periods to get the needed returns for their later years.

And it paid off.

But as you know, the stock market is no longer paying off for most investors in 2022.

Fortunately, thanks to the Federal Reserve… TINA is no longer with us. If you’re looking to build your nest egg today, you have alternatives for the first time in more than a decade.

Put simply, soaring interest rates are working in your favor. That’s huge for your retirement.

Let me explain…

Back in January, I introduced readers to the “bucket” strategy. As I said…

It was the strategy I used over my 25 years working for some of Wall Street’s biggest names. And it’s not only for the big money… You can do it, too!

In fact, I believe the bucket strategy is the best way for you to approach retirement. It’s a fundamental approach. And it’s easier than you might think to execute…

The trick isn’t some special set of asset classes. In reality, a diverse portfolio is the goal. And remember, you’re using it to build a steady income stream for the long haul.

The goal is to build several “buckets” earmarked for five-to-10-year segments. And for each bucket, you want to be able to fund your income needs over that specific time period.

With interest rates up significantly since January, it’s a great time for us to address the early buckets. More specifically, we want to focus on the short end of the yield curve…

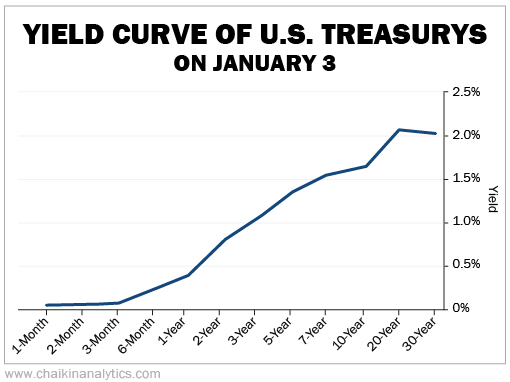

You see, in January, rates on the short-term side of the yield curve were below 0.5%. The six-month U.S. Treasury bill yielded 0.22%. And the one-year U.S. Treasury yielded 0.4%.

Here’s what the yield curve across the spectrum of U.S. Treasurys looked like back then. It’s considered “normal” – meaning the longer-maturity end of the curve offers higher yields…

However, with yields so close to zero on short-term U.S. Treasurys, they were a bad bet for retirees. These folks couldn’t earn any short-term income. They were still stuck with TINA.

But things have changed in a big way over the past nine months…

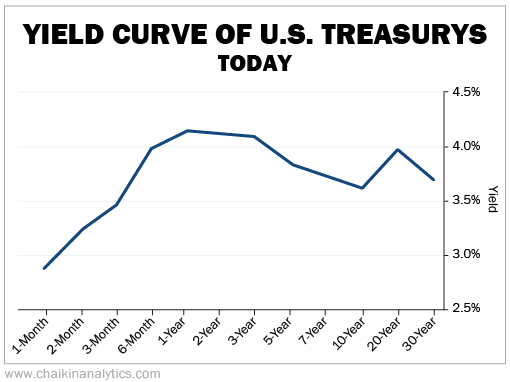

Six-month U.S. Treasury bills now yield nearly 4%. And the one-year U.S. Treasury yields around 4.2%. That means they’ve surged more than 1,800% and 1,000%, respectively.

Today, the rates on these short-term U.S. Treasurys are higher than longer-term bonds. That’s where the term “inverted” yield curve comes from. Take a look…

As you can see, the six-month U.S. Treasury bill’s yield now exceeds the 30-year U.S. Treasury bond’s yield. That’s nuts!

In other words, people want a larger return on the debt scheduled to come due in the next six months than they do for the debt scheduled to come due 30 years from now.

The stock market is a struggle for folks entering retirement these days…

But fortunately, TINA is no longer with us. Start using higher rates to your advantage.

High short-term rates are bad for the market. But they’re a major win for retirees looking to build their income.

Don’t miss this terrific way to set up your early buckets today.

Good investing,

Pete Carmasino