“Thematic” funds have become all the rage over the past 20 years…

But it might surprise you to learn they’re not that modern. In fact, they go all the way back to the late 1940s. Back then, a new theme was starting to work its way into American life…

Television.

The U.S. only had around 1 million TV sets in 1948. And color TV wasn’t a thing yet.

But a group of investors saw a massive growth opportunity…

The Television Shares Management Corporation launched the Television Fund that year. Then, in 1950, it switched the name to the Television-Electronics Fund to better align with the broadening theme.

Seven decades later, the idea of investing in a thematic fund remains the same…

First, you want to find a sector or industry that’s either new or entering a growth period. Then, you want to leverage all the data you have to try to profit from the shift.

That’s what I did in one Chaikin PowerFeed essay last summer. It ultimately led to my best winner in 2023.

And as I’ll explain today, my process is pointing to another thematic opportunity right now…

Specifically, I wrote about the ETFMG Prime Cyber Security Fund (HACK) last June.

The Power Gauge rated HACK as “very bullish” at the time. And its Power Bar ratio looked great. HACK held 27 “bullish” or better stocks and only one “bearish” or worse stock.

With the Power Gauge’s help, I saw that HACK’s setup was overwhelmingly positive.

The fund has outperformed the market since then. It’s up around 19% over the past six months. That’s a lot better than the S&P 500 Index’s roughly 7% gain in that period.

I took things a step further for the paid subscribers of my Chaikin PowerTactics service. A week after I published the Chaikin PowerFeed essay on HACK, I recommended cybersecurity leader CrowdStrike (CRWD).

CrowdStrike became my best winner in 2023. It’s up about 75% since my recommendation.

So as you can see, thematic funds can be a steppingstone to other opportunities. But at the same time, they can also be great on their own. They can help you diversify your risk…

With a thematic fund, you’re not putting all your eggs in one basket. You don’t need to pick the winner in the space. You can own them all and profit as the broader idea takes hold.

To that point, another theme looks interesting to me right now…

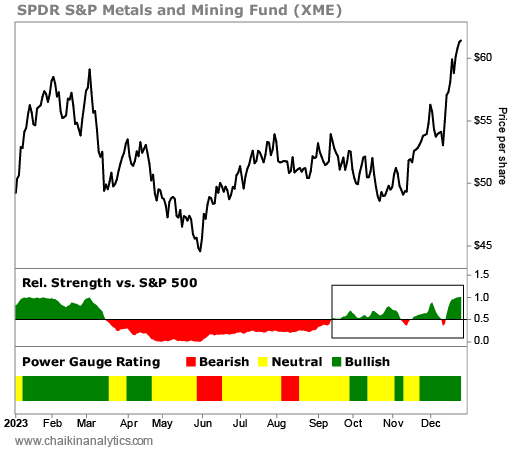

I’m talking about metals and mining. We track this theme in the Power Gauge with the SPDR S&P Metals and Mining Fund (XME). Here’s the one-year chart for XME…

In the panel below the main price chart, I highlighted XME’s recent “relative-strength change” with a box. The fund started outperforming the S&P 500 in mid-September.

That’s an important development. It tells us the trend is on our side with XME today.

For this theme’s breakout to continue, a couple things need to line up…

It starts with the costs of raw materials and energy. Oil is down more than 20% from its most recent peak of about $94 per barrel in September. It’s around $72 per barrel today. Lumber and steel prices have fallen from their recent peaks, too.

The second piece of the puzzle is rising consumer demand. And as we head into 2024, the best catalyst for rising demand is lower interest rates…

The Federal Reserve expects to cut rates this year. That will lead to higher demand in industries like metals and mining.

After all, metals are base materials for nearly all manufacturing. Lower rates make it cheaper to invest in these areas. And interest is already surging in this space…

A couple weeks ago, Japan-based Nippon Steel offered about $15 billion for U.S. Steel (X).

The deal is under scrutiny because the potential buyer of this iconic U.S. company is from Japan. And some folks don’t believe the deal would be in our best interest as a country.

But for our purposes, the more important point is clear…

Metals and mining are in play. So I recommend keeping your eye on this space today.

Good investing,

Pete Carmasino