Folks, there’s no question that the past month was dramatic…

Election coverage dominated the news. The political horse race marched on.

But then, the unthinkable happened.

At a Republican rally in Butler, Pennsylvania, a young man climbed up onto the roof of a nearby building. And he managed to shoot at former President Donald Trump.

The assassination attempt failed. But it was shocking. And it was terrible. One man in the crowd was killed and two others were wounded.

But you’ll notice that it hasn’t been the focus here at Chaikin Analytics.

The reason is simple…

Put simply, the markets brushed it off. And my general election-year thesis is still in place.

Regular readers know that I believe the market is still capable of a big move higher in 2024. That’s true despite the staggering 15% the S&P 500 Index has already climbed this year.

Of course, the political coverage is gripping. And I understand why just about everyone is tuned in right now.

But across our publications here at Chaikin Analytics, I’ve previously told folks that it’s a “national distraction.” That’s especially true for investors like us.

As I said back in the February 22 Chaikin PowerFeed…

This is a critical moneymaking moment for the mainstream media and their advertisers. Keep in mind that 2023 was a terrible year for cable news…

That means the networks will do everything they can to keep your eyes on their election coverage.

In the wake of the assassination attempt on Trump, that’s more true than ever. The political volatility is on the news. And the media wants your eyes glued to that coverage.

But we need to be paying attention to the volatility in the markets.

In the past month before last week’s breather, the S&P 500 had surged more than 4%. In fact, it outperformed the tech-heavy Nasdaq 100 Index.

Now, we’re beginning to see the bull market expand beyond the “Magnificent Seven” mega-cap stocks. And that means the market is presenting investors with more interesting opportunities.

I expect this trend to continue.

Rate cuts are finally on the horizon. The Federal Reserve has signaled that inflation is approaching its preferred target.

This is great news for companies outside the Magnificent Seven. Put simply, smaller companies are often more sensitive to the cost of debt than the largest companies.

That means that lower interest rates can create a significant tailwind for the broad market. Cheap debt means easy growth.

And the market is responding to this…

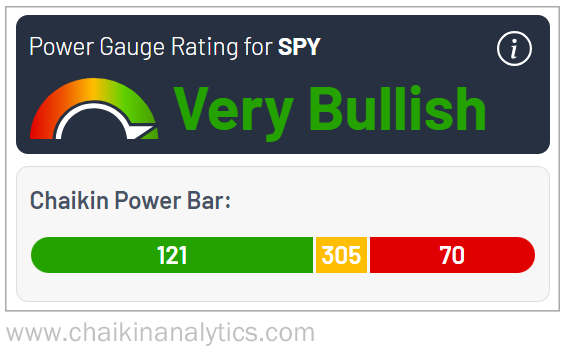

Right now, the S&P 500 – as measured by the SPDR S&P 500 Fund (SPY) – earns a “very bullish” rating in the Power Gauge. Take a look at this screenshot from our system…

You’ll also notice that the ratio of “bearish” to “bullish” stocks is incredibly favorable. As you can see, 121 stocks in the S&P 500 earn a “bullish” or “very bullish” rating. Meanwhile, 70 earn a “bearish” or “very bearish” rating.

So, the political news is about as loud as it gets right now. And that’s going to continue.

The media wants your eyes focused on the election. But don’t let that fool you…

This is a big year in the market. And it’s continuing to be a big year. Looking ahead, I’m still optimistic on stocks for the rest of 2024.

Good investing,

Marc Chaikin