Last week, my colleague and Chaikin Analytics founder Marc Chaikin shared a message about a coming “national distraction”…

Folks, we’re already seeing that play out.

As we all know, 2024 is an election year. And that means the media is running full tilt. As Marc said last week…

This is a critical moneymaking moment for the mainstream media and their advertisers. Keep in mind that 2023 was a terrible year for cable news. Some networks lost up to a quarter of their average audience in just 12 months.

That means the networks will do everything they can to keep your eyes on their election coverage.

For investors, it’s a distraction. And it’s one that could lead you to missing a huge opportunity that’s unfolding right now.

Today, we’re seeing a not-so-new form of this distraction playing out. It’s one that the media and politicians seem to love.

But average Americans – the “mom and pop” investors – hate it.

Now, I’m no fan of politics. And here at Chaikin Analytics, our goal is to uncover investment opportunities no matter what’s going on in the political landscape.

But the problem is simple. The national distraction will leave some investors sitting on the sidelines.

It will derail investment plans. And it will make fools of the investors that don’t respond correctly to it.

So, today we’re wading into the muck and uncovering the latest distraction…

If you haven’t heard already, yet another government shutdown is looming.

This Friday at midnight, unless the government acts, parts of government food, housing, and veterans’ programs will lose funding.

This would be a partial shutdown. The rest of the funding will run out at midnight on March 8.

I’ll spare you the details of what a mess this would be. In the coming days, the mainstream media will increasingly be all over the story.

And you’ll get to see all the finger pointing, too…

Folks, that’s not why we’re here. After all, we’re looking for opportunities in this market.

And it turns out that the government shutdown… just isn’t that relevant.

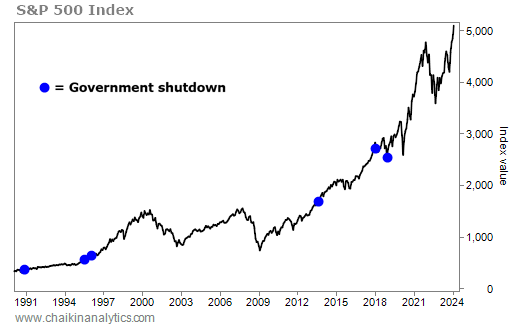

The chart below shows the benchmark S&P 500 Index since 1990. And I’ve added a dot for each government shutdown we’ve had since then. Take a look…

Normally, when I show you a chart, you’d expect to see a clear pattern. But this one’s a little different…

We’ve had six government shutdowns since 1990. And they’ve cost the U.S. government about $7.5 billion.

But on the chart, the story is a little different. And that’s because the shutdowns just don’t have a whole lot to do with the stock market.

Sure, they can be painful for people. Shutdowns mean delays in government spending on goods and services. They also mean uncertainty for furloughed federal workers.

But on the macroeconomic level over the long term… it’s just a distraction.

So as the election cycle heats up, expect a lot of fiery rhetoric on both sides of the political aisle. And be ready to hear every doom-and-gloom scenario the media can cook up.

But remember, we’re in an election year. Politicians are going to do just about everything they can to score their points. But don’t let them fool you.

There are opportunities in this market. You just need to know how to look past the distractions.

Good investing,

Vic Lederman

P.S. When it comes to opportunities, that’s exactly what Marc will be covering during his on-camera appearance this Thursday…

At 8 p.m. Eastern time, Marc will explain the one move he says you need to make before Super Tuesday to position yourself for investing success in 2024.

And just for tuning in to this special event, he’ll also reveal what he believes will be one of the year’s top-performing stocks… and one stock he believes you need to avoid at all costs for the remainder of 2024.

Marc’s event this Thursday is completely free to attend – we just ask that you reserve your spot in advance. You can do so right here.