The market just keeps dodging everything thrown at it…

Economists and fundamental analysts continue to debate the state of the economy. And strategists are arguing whether we’ll endure a hard or soft landing.

These so-called market experts’ persistent fears of a recession have kept many folks on the sidelines since the October 2022 lows.

Meanwhile, job growth continues to be strong. The unemployment rate is near record lows. And let’s not forget about the banking crisis – which claimed another victim over the past month.

Now, with this much confusion, I can’t blame people for being cautious. More than $5 trillion sits in money-market funds today.

Fortunately, we can take a better approach. With the Power Gauge’s help, we can capitalize on the best opportunities. And right now, stocks are in a good spot…

So, today, let’s take a closer look at why I’m optimistic. I’ll also share the exact number I want to see the S&P 500 stay above. It’s my medium-term “bullish” threshold.

Let’s get into it…

Through four-plus months of this year, the S&P 500 is up more than 7%. And the Invesco QQQ Trust (QQQ) – which tracks the tech-heavy Nasdaq 100 Index – is up an incredible 22% over that span.

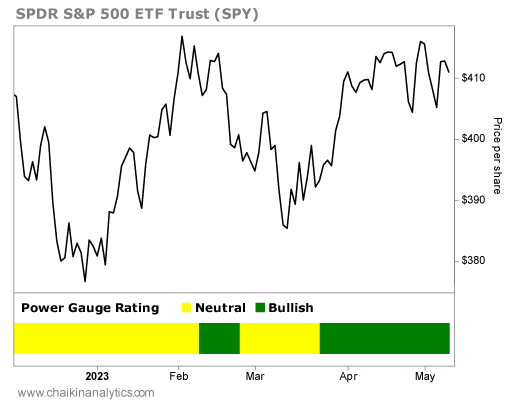

Not surprisingly, the S&P 500 maintains its “bullish” Power Gauge ranking, too. Take a look…

Has the market’s climb been choppy? Absolutely.

You can see the volatility on the chart. And I think it’s fair to say that this year’s news cycle has felt harrowing at times. But that doesn’t negate the broadly improving economic conditions we’re seeing.

As I told paid subscribers last month…

There’s a silver lining in the banking crisis, too… The Fed now has the cover it needs to pause – and likely end – its rate hikes. That will likely happen after the expected 25-basis-point increase at the May meeting of the Federal Open Market Committee.

Well, the Federal Reserve completed the final part of that statement last week…

It raised the benchmark federal-funds rate by 0.25% (25 basis points). The target range now sits between 5% and 5.25%.

The market overwhelmingly believes the Fed will soon pause its rate hikes as well…

CME Group – which runs the Chicago Mercantile Exchange – maintains a FedWatch Tool to try to predict the central bank’s next moves. Right now, it currently projects more than a 90% chance that rates will remain unchanged at the Federal Open Market Committee’s (“FOMC”) next meeting in June. (The FOMC is the Fed’s policymaking arm.)

Once again, we’re seeing the S&P 500’s headwinds diminish. The problem of inflation is subsiding, which means the Fed is able to relax its aggressive posture.

Still, I understand the “what’s the bullish threshold” question I’m getting…

Obviously, I’ll be using the Power Gauge as my guiding light. Its nuanced approach means that every stock in the S&P 500 receives an individual rating. The proprietary weighting of those ratings produces the “bullish” ranking S&P 500 funds, like SPDR S&P 500 Fund (SPY), receive.

That said, I can offer you a single number that I’ll be watching closely.

As long as the S&P 500 stays above its December 2022 low of about 3,760, I’ll remain “bullish” on stocks. And I still recommend focusing on stocks in strong industry groups with “bullish” or better Power Gauge ratings – like the now-soaring software industry group that holds 160 bullish stocks and only eight bearish stocks.

Good investing,

Marc Chaikin