Folks, it’s easy to get distracted by negative news…

After all, there’s a lot going wrong in the world.

Fighting continues in the Middle East. And the conflict is ongoing in Ukraine. Beyond that, tensions between the U.S. and China are high.

And despite the improving economy, many consumers feel like things are terrible right now.

Put simply, the negative narratives out there can feel overwhelming.

But folks, the data is dramatically different from that.

That’s especially true in the stock market. In fact, signs point to the possibility that we’re in the early innings of a runaway bull market. But that doesn’t mean you can throw caution to the wind.

Today, I’ll use the Power Gauge to explain what I mean…

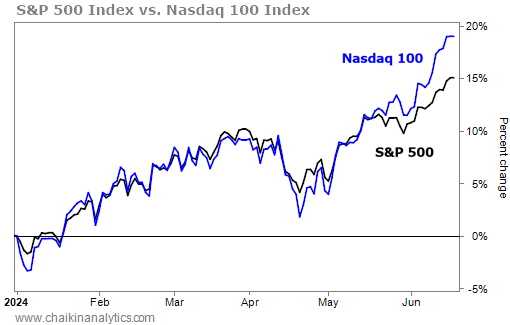

After a brief pause, the market is making another big move higher. The S&P 500 Index is up about 3% over the past month.

We’re talking about roughly six months’ worth of the index’s typical gains in a single month.

Meanwhile, the tech-heavy Nasdaq 100 Index has soared about 6% over the past month.

Despite some small pullbacks, both indexes have kept making record high after record high this year.

Put simply, it’s looking like we’re in a runaway bull market.

And it’s clear on the chart. Take a look…

So far in 2024, the broad market S&P 500 has gained an incredible 15%. And the Nasdaq 100 is up about 17%.

Folks, we have to keep this in perspective when we see negative news.

Many people feel bad about the state of the world. That’s their right to feel that way. I’ll also acknowledge that across the globe, terrible things are happening – and many folks are struggling.

But there’s no getting around the fact that the markets are soaring.

With that said, this doesn’t mean to run out and just buy anything…

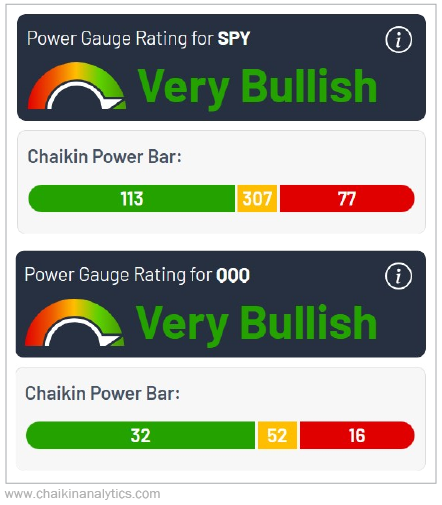

Take a look at the Power Bar ratings below for the S&P 500 and the Nasdaq 100. In our system, we use the SPDR S&P 500 Fund (SPY) and the Invesco QQQ Trust (QQQ) to measure those, respectively. And here’s what the Power Bars look like…

In both cases, the majority of the stocks in these funds earn a “neutral” or worse rating from the Power Gauge. That means that that just a select few stocks are responsible for this rally.

That means differentiating between the “good” stocks versus the “bad” stocks is more important than ever.

More specifically, you want to make sure you’re in the “bullish” names… and avoiding the “bearish” ones.

Beyond that, you need to understand what this incredible market concentration means. U.S. stocks are at their most concentrated levels ever. And that has big implications for some very specific segments of the market going forward.

That’s why next week, I’ll be going on camera to share the details of my next big prediction…

I’ll also share an investing strategy that could make you bigger gains than anything I’ve ever used the Power Gauge for before.

No matter how you’ve fared in the markets in the past few years, take my word that it’s all on the line today.

My special event with all the details is next Wednesday, June 26, at 8 p.m. Eastern time. And it’s completely free to attend – you just need to reserve a spot in advance. You can do so right here.

Good investing,

Marc Chaikin